Land Purchases & Sales

- Adam Garrett

- Feb 3, 2023

- 18 min read

Updated: Oct 14, 2025

I was asked today some good questions about land that I felt deserved an article.

General Concepts:

Where to Find Land

The place to start will be with a listing agent that has access to the MLS in the cities/counties that you're considering. However, unlike home purchases, it's critical to not stop there, & have feeds set up with more than 1 source.

For instance, with land purchases, I've seen where 3 of 17 results used Bright MLS out of those options shown on Zillow, despite the fact that Bright MLS is by no means the dominant MLS in Southampton County. Conversely, I didn't see any property other than land that used Bright MLS in Southampton County on Zillow.

Per Remarkable Land w/ some of my details added, here are some additional locations to look for land:

Land.com (similar inventory on Land & Farm & LandWatch) you can add multiple counties &/or cities & draw a search area on Land.com, while the other 2 don't have that feature.

The inventory isn't as high as Zillow & Realtor.com, but the search features available are more geared toward land than Zillow.

Realtor.com (highest inventory, but achieves that partially by including adjacent counties/cities)

Zillow.com (more true inventory than the 3 in #1 in a sample county I checked) - I also like how you can draw on a map the area that you'd like to search in.

Loopnet is also going to provide some additional land inventory (especially commercial) not visible in any of the prior 3 sections. Be sure to make sure that you have adjusted the toggle to "for sale" if you're seeing no results or land for lease at first. Also, you may need to adjust to land more than once to narrow things down to just land.

Facebook Marketplace & Facebook buy/sell groups, some of which are dedicated to land & geographically oriented towards a state or region. However, there are a lot less "land" for sale than homes for sale groups, so you may need to look in general sales groups or statewide land groups. Here are some examples in Virginia, mostly from a Facebook search for ""land" for sale virginia":

Land For Sale in Maryland, Virginia, and Washington DC. RES & COMM

I generally don't recommend a nationwide or global group, like the global group Land for sale.

Looking up your state or local area and "real estate" can also pull up some options, like RVA Off-market Real estate

Google is another viable option, and you can be as specific as you'd like on it.

If you're in TX, a big brokerage there is Texas Hunting Land

Risk considerations for buyers

Land deals are inherently more risky to buyers than residential home purchases. Lenders see the foreclosure data & know this fact. Land loans are higher risk for lenders since the seller often doesn't have a rental use for land as an option that meets or comes close to the demands of the mortgage, unlike a typical residential single family purchase. That's why you'll see stricter criteria typically for land & construction to perm loans vs typical residential single family mortgage loans.

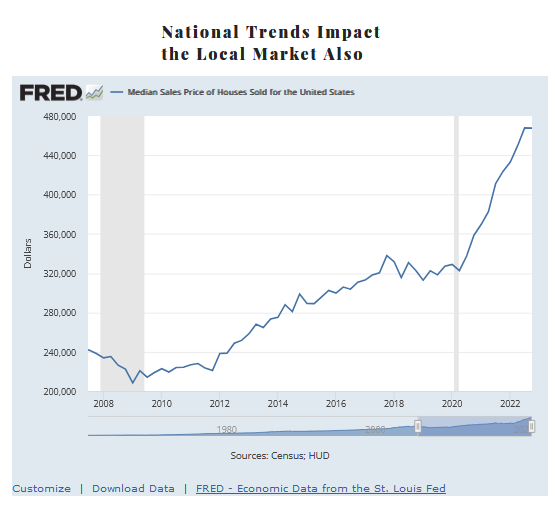

Where have land prices gone nationally and where are they headed?

Land prices don't go right with home prices. For instance, the national trends have been a 45% gain in price for houses in the US from 2020 to now, while the gain has been around half that amount for farm real estate values in the same period.

Here's a more long term value of land per acre that provides inflation adjusted values, per USDA:

Farm Land Values by State

Housing Starts

One of the best places to look if you're planning on buying land in a location for building homes is the United States Housing Starts graph which shows both where housing starts have gone over the years and where they are trending to go, with higher housing start trends typically meaning the higher opportunity for growth in value. As you can see below, we're in a downward trend as of 2/3/23:

Does Adam help people sell & acquire land? Yes

In addition to my assistance with residential single-family homes, I can also assist with multi-family, commercial property, & land. I've helped buyers acquire land and sellers sell land, and am open to more business in land as long as the purchase would be in the price range in that location of my coverage area. When it's not, I can often provide a referral.

Note on Catfish Sellers with Land for Those Not Meeting Adam at the Property

Catfish buyers & catfish sellers are such a problem these days that some weeks, I get contacted by more catfish than by legitimate prospective clients. In fact, I'd probably say that the majority of land "sellers" who contact me who don't want to meet me at the property in person are actually catfish. In light of this major problem, it's important for me to guard my time for legitimate prospective clients and clients by having policies that will mitigate the likelihood that I'm wasting my time & hurting legitimate clients in the process who have less time available from me because of it.

When Additional Protocols Are Not Necessary

If Adam personally knows the person selling & is able to confirm that it is not someone impersonating them by speaking on the phone with them in advance.

If referred by someone Adam has met or knows from in-person interaction where the one referring states that they know them from in-person interaction.

When Additional Protocols Are Necessary

Most other cases not mentioned above when Adam won't be meeting the seller at the property.

Additional Protocols When Necessary for Remote Sellers Not Meeting with Adam on the Property

It's a good idea for real estate agents to protect themselves by, according to the Financial and Consumer Services Commission, doing the following:

"Confirm all documentation (ie: driver’s licence, government issued-ID) to ensure identity, especially if you don’t meet the client in person and are dealing exclusively via email or text message."

A number of sources on catfish buyers and sellers recommend

Before starting listing paperwork on a land sale and before visiting a property for a seller, I require proof of ownership. That could look like emailing me 1 of the following:

The closing paperwork

The deed

A copy of a recent tax statement for the property (not simply what can be pulled online on the city/county website)

Additional supporting documentation that can be helpful with alleviating my concerns, if available, include:

A survey of the lot

A wetlands delineation (if applicable)

An elevation certificate (if applicable)

A septic inspection or PERC test

A well inspection or related test

Invoices from any work done on the property, whether single-time work, ongoing maintenance like grass cutting, or otherwise.

It would also be important to send me the identification mentioned by the Financial & Consumer Services Commission. For that documentation, it's best to have one version of it scanned or in a high-resolution image by itself. While not necessary if you will also be doing face-to-face video, if not doing face-to-face video, please send me another where you hold it up close to your face where I see both your face and the identification in the same image.

Where can I find out more about a land or new construction purchase?

Here's a Google Doc I've written on new construction, much of which is about the purchase of land & thereby applicable whether you're just purchasing land without any desire to build, want to buy land now and want to build eventually, or want to buy land and immediately start planning and subsequent construction. In that document, I go over unique aspects of land purchases that you often won't hear about with purchases of existing single-family homes like setback restrictions, wetlands, etc.

My Policies to Mitigate Risks for Buyers with Out-of-Town Land Sellers I Represent

Per the NAR recommendations, I seek face-to-face meetings in person or virtually, check phone numbers I am being called from, ask for documentation that would prove ownership and identify the owners, and more if I don't know someone reaching out about selling land.

Here are some additional tips to agents from NAR:

"Do your due diligence to verify that the purported seller is the actual property owner. For example, ask for multiple forms of identification and proof of ownership and request a face-to-face meeting. Test their knowledge about the property by seeking information that isn’t available in public records or information readily available online.

Second, conduct independent research to confirm the property owner. Look online for a recent photo and consider contacting their last agent or a neighbor. And try to verify the seller’s email and phone number.

Third, avoid having the seller arrange for the notary at closing. Instead, ensure that the notary is a vetted, independent, and approved remote online notary and confirm remote notarization is permissible in your state. Otherwise, allowing the title company to select the notary is always a good option.

Fourth, ask the seller to provide a copy of a voided check with a disbursement authorization form. And use a wire verification service to confirm accuracy of the account information and ownership.

Lastly, if you suspect that you’re involved in a vacant lot scam, contact law enforcement by filing a complaint at IC3.gov, and reaching out to federal, state, and local authorities. And work with your MLS to have the property listing removed and take down any advertisements about the property as quickly as possible."

Elements of Land Purchases & Sales to Check:

Check the Association Regulations

If purchasing land for the purpose of building in a homeowner's association, condo association, or other association, be sure to know about what rules and regulations are involved on your usage of the land/building you plan to put on the land, especially architectural regulations. Architectural regulations may include rules on minimum square footage (that will price some out of a neighborhood immediately), types of siding that may be used (i.e. prohibiting lower cost materials like typical siding), prohibiting modular homes, requiring paved driveways, limiting color selection, etc.

In considering properties, it's ideal if you can get the association regulations prior to seeing land. If a listing you're considering doesn't have it, see if it's available elsewhere, such as in other available properties in the neighborhood or past sales. Your agent can accomplish this task much more quickly than you can, since it's not unusual for this information to be on MLS.

VA Peninsula Hack:

While it's not all up to date, the number one place I've seen with HOA documents online in SE VA is on the HOA doc page of Mr. Williamsburg. Sure he's my competitor, but that doesn't mean I'm going to hold out on information for you or plagiarize.

Check the Department of Health Records

The department of health may have a number of records that the owner may not have on file already, especially if they are not the original owner. Well tests, surveys, and perc tests are all possibilities with land and the department of health records.

For sellers, you can have a more accurate listing this way. I've seen where a listing agent didn't even know that the property had a septic system, the county website didn't list whether it had a septic or not, and where if it wasn't for the buyer's agent (me) thinking it still had a septic system that was nowhere in plain sight (it was under a deck), the buyer could have purchased it based on the inaccurate information, then gone after the seller once they found out later that there was false advertising.

For buyers, going about this process is also an easy way to find out more information to help inform your decision since the seller may be intentionally not providing information or may be listing the property inaccurately (i.e. higher bedroom # than the septic that the property is rated for).

If in VA, there is a relatively simple streamlined process to go about this task, though it can take 5 days to hear back at times.

VA Department of Health Request Link: https://vdh.nextrequest.com/

Check the Utilities Available

It's important to know the utility options available in an area as those can increase or decrease the costs involved in a land purchase as long as you plan to buy land where you plan to need a well, septic tank, electricity, or otherwise.

Of course, there are workarounds in some cases when utility lines aren't available, like:

Propane can come via truck. That said, often propane will be pricey to operate.

Solar panels make sense much more in some scenarios than others and don't tend to make as much sense for those who are not planning on being somewhere for less than 12 years in SE VA where sunny days aren't as prevalent as places like Southern California, where electricity is cheap, and where government tax incentives aren't as strong as places like California. That said, it really depends on your individual circumstances, so here's an article on solar panel calculation from CNET.

Related:

Check the State, Local, & Zoning Regulations

While typical of commercial buyers, many familiar with purchasing resale homes & purchasing land are unfamiliar with the importance of checking the zoning regulations for a wide variety of elements of the use of the land, from setback restrictions, to permitted uses, to gun regulations, etc. Start by knowing the state regulations (i.e. construction code). Within the same city/county, different zoning types can have very different rules. 2 cities/counties can also have very different rules even when comparing zoning types that are otherwise similar.

For a bit of a cheat sheet for SE VA, go to my article on the subject here, and within the link I put at the top, go to "law" where I have some information as well as links to a number of county/city websites on various subjects like setback restrictions & building ordinances. If you're my client, and you'd like me to add more to fill in some gaps, just let me know.

Check for (or rule out in your search creation) Flood Zones & Hurricane Evacuation Zones

Here's the hurricane evacuation zone map:

While unusual among agents (likely <1%), Adam has created an option to filter out most hurricane evacuation zones across 4 of the MLS in SE VA, so if you'd prefer to avoid those, just let him know.

Check for Flood Zones within the Matrix MLS portal your agent can set up.

While he's spent hours in attempts, Adam hasn't been able to successfully create comparable flood filter templates like his hurricane evacuation zone template. That's due to the higher degree of complexity of flood zones and due to the limitations of the Matrix portal in only 10 polygons and a limited number of data points within each polygon before the polygon reverts to a lower number when completing it.

Check Wetlands

Wetlands can drastically negatively impact land for certain uses, while positively impacting it for other uses.

Wetlands in & surrounding hunting land can positively impact the ability for wildlife to thrive & can help preserve a natural & more private view.

Conversely, wetlands can drastically negatively impact the ability to build on wetlands or near wetlands.

The impact adjacent to wetlands is typically 100' for lots created on or after the 1988 enactment of the Chesapeake Bay Preservation Act for properties in & around it & occurs in "estuarine & marine deepwater" & "estuarine & marine wetlands" in the map below. See Virginia: 9VAC25-830-80. Resource Protection Areas.

If a property is impacted by wetlands, it's best to get a wetlands delineation prior to building, as the map below will not be as accurate as a wetlands delineation. Buyers should get this delineation during the study period if they don't have it already and sellers should ideally get it before offering it for sale.

Road Frontage

A typical requirement for building on a lot is the amount of road frontage. This amount can vary substantially depending on zoning within a city/county and by locality. There are also special circumstances that may reduce the requirements, such as a family wanting to subdivide to sell or gift to a family member.

Easements

When a lot doesn't have any road frontage, there are various kinds of easements that are sometimes possible. It's typically best to seek out a written easement prior to listing a home for sale and prior to purchasing.

Acreage

Often, localities have minimum acreage requirements for lots, and these can also vary wildly depending on locality and depending on zoning within a locality. For instance, Newport News has minimum requirements in R4 zoning of 6600 sq ft. In R1, which like R4 is designed for single family residential, the square footage minimum increases to 20,000 sq ft (.459 acres). Meanwhile in Gloucester County, per section 15-31, "Subdivisions served by private roads shall be permitted where the design of the division of land is such that no lot is less than five (5) acres in area and the private road serves no more than three (3) lots or dwelling units."

While state law varies, in some cases, use of an area in excess of 15 years (20 in other cases) in VA creates a situation where someone who is using an area and satisfying various requirements long enough gets ownership rights to that land.

More Area Elements

Loan Considerations:

Disclosure: #'s & my Business

Keep in mind that any of the numbers below may have changed since the times when I learned about them. Also, I am not a lender.

Land Only vs Construction Loans

Often with land purchases whether you want to build within a short time or whether you want to keep the land a long time before building will determine what loan type you'll be using. There are land-only loans and "construction to perm loans". The former is designed to be paid off without any construction costs wrapped in, but sometimes are converted. The latter is designed to go from a land/construction loan to a more typical loan (i.e. a 30-year loan) with higher interest rates and terms at first and lower interest rates/terms later after construction is complete. Just because a lender can do a construction-to-perm loan doesn't mean that they can do a land-only loan. It's not just as simple or land only or construction to perm either. Some construction to perm loan options/lenders can only do stick-built construction, while others can do stick-built & modular homes, but not manufactured homes. Both construction-to-perm & land only loans often have balloon payments at the end where a lump sum is expected after a period of fixed payments.

Farm Loans

NerdWallet: Farm Loans: Best Options and How to Get One

USDA Farm Service Agency Loan Interest Rates, like their counterparts for USDA direct loans for homes, are typically relatively competitive even when compared to interest rates for houses with traditional lenders if they are direct loans rather than through a traditional lender (guaranteed loans). In addition, down payments can be as low as 1.875% (as of 3/12/25) for a farm ownership loan. That said, farm service direct loans have $900k/yr income limits and lower max loan limits.

Per USDA Farm Loan Programs:

"Farm Operating Loans can be used to purchase livestock, seed and equipment. It can also cover farm operating costs and family living expenses while a farm gets up and running.

Farm Ownership Loans can be used to purchase or expand a farm or ranch. This loan can help with paying closing costs, constructing or improving buildings on the farm, or to help conserve and protect soil and water resources.

Microloans are a type of Operating or Farm Ownership Loan. They’re designed to meet the needs of small and beginning farmers, or for non-traditional and specialty operations by easing some of the requirements and offering less paperwork.

Youth Loans are a type of Operating Loan for young people between 10-20 years old who need assistance with an educational agricultural project. Typically, these youth are participating in 4-H clubs, FFA , or a similar organization.

Native American Tribal Loans help Tribes acquire land interests within a tribal reservation or Alaskan native community; advance current farming operations; provide financial prospects for Native American communities; increase agricultural productivity; and save cultural farmland for future generations.

Emergency Farm Loans help farmers and ranchers recover from production and physical losses due to drought, flooding, other natural disasters or losses.

A portion of FSA loan funds are set aside for Minority and Women Farmers and Ranchers to buy and operate a farm or ranch.

A portion of FSA loan funds are set aside for Beginning Farmers and Ranchers – family farmers who are just getting started on their journey in farming."

Farm Storage Facility Loan (FSFL) Program "provides low-interest financing so producers can build or upgrade permanent and portable storage facilities and equipment. Eligible commodities include grains, oilseeds, peanuts, pulse crops, hay, hemp, honey, renewable biomass commodities, fruits and vegetables, floriculture, hops, maple sap, maple syrup, milk, cheese, yogurt, butter, eggs, meat/poultry (unprocessed), rye and aquaculture. Eligible facility types include grain bins, hay barns, bulk tanks, and facilities for cold storage. Drying and handling and storage equipment is also eligible, including storage and handling trucks. Eligible facilities and equipment may be new or used, permanently affixed or portable.

Conservation Assistance

Conservation Reserve Enhancement Program (CREP)

"Partners work with FSA to develop CREP agreements designed to address specific conservation challenges in targeted geographic areas. The program encourages farmers and landowners to enroll in long-term conservation contracts, removing environmentally sensitive land from agricultural production and implementing conservation practices. Participants receive annual rental payments, cost-share assistance for establishing conservation practices, and other financial incentives."

Conservation Reserve Program (CRP)

"Encourages farmers and landowners to convert highly erodible and other environmentally sensitive acreage to vegetative cover, such as native grasses, trees, and riparian buffers.

By enrolling in CRP, participants receive annual rental payments and cost-share assistance to establish long-term, resource-conserving covers. The program helps to improve water quality, control soil erosion, and enhance wildlife habitat, contributing to overall environmental health and sustainability."

Farmable Wetlands Program (FWP)

"FWP encourages farmers and landowners to restore farmable wetlands and establish conservation practices to improve environmental health. The program targets specific areas of non-floodplain wetlands that are suitable for restoration. Participants receive annual rental payments, cost-share assistance for establishing conservation practices, and other financial incentives for the duration of their contract, typically 10 to 15 years."

Organic Certification Cost Share Program (OCCSP)

"OCCSP provides cost share assistance to producers and handlers of agricultural products who are obtaining or renewing their certification under the National Organic Program (NOP). Certified operations may receive up to 75 percent of their certification costs paid during the program year, not to exceed $750 per certification scope...

Eligible OCCSP applicants include any certified organic producers or handlers who have paid organic certification fees to a USDA-accredited certifying agent."

Water-Saving Commodities (WSC) Program

The Water-Saving Commodities (WSC) Program is a new effort by the Farm Service Agency (FSA) to support agricultural commodity production while reducing water losses in places experiencing impacts from drought. Through this program, grants will help producers, and the organizations delivering water to producers, build long-term drought resilience and expand market opportunities.

Disaster Assistance

Per the USDA Farm Service Agency Farm Bill Home:

Disaster programs provide much needed support for agricultural producers in their recovery from crop, land, infrastructure, and livestock losses and damages due to qualifying natural disaster events. FSA’s disaster assistance programs are authorized outside of the Farm Bill, and this extension has no impact. Available disaster programs include:

Down payment requirements are typically higher

Down payment requirements are typically higher for a construction to perm loan (& even more so with land only loans) than for an owner-occupied home (i.e. 10%-20% is typical for construction-to-perm loans). According to USDA, "We offer mortgage loans with low rates and no down payment requirement for low-income residents in rural areas who wish to buy or build a home." I've seen as low as 5% for a construction to perm loan that wasn't as restrictive as USDA.

Interest rates are typically higher

Interest rates are typically higher (while land or incomplete construction at least) vs a typical single-family investment mortgage on an existing home.

Shorter Amortization Timeframes

Also with land, typically you're not looking at 30-year loans like you would with a single-family home unless the loan is converted to a 30-year loan after a home is built. That means higher payments required and higher difficulty with debt-to-income ratios. While there are likely higher timeframes out there, the highest timeframe for a land-only loan that I've seen is 20 years. 5-year loans max is not uncommon with some banks.

Less Programs to Reduce Home Costs, but Some Are Still Available

While there aren't as many options with land purchases and construction loans for reducing your costs, there are some that are still available.

Below are a few examples available with qualified buyers in certain rural areas (i.e. parts of York County, most of Gloucester County, most of Isle of Wight County, etc.).

Image courtesy USDA

Land Options:

For instance, USDA has a product (1, 2) for "Beginning Farms and Ranchers". Qualified applicants can get a partial loan for up to 45% of the purchase price of the lot in some scenarios where there is a 20-year loan term & where the "Interest rate is 4 percent below the direct farm ownership rate, but not lower than 1.5 percent." Alternatively, there's an option where "The interest rate is 2 percent less than the direct farm ownership rate but not lower than 2.5 percent. The term of the loan will not exceed 40 years or the useful life of the security."

Construction Options:

Again, USDA has a product available, and unlike most construction products, no down payment is required. Here's more on that from Forbes.

Related for Buyers:

Related for Sellers:

Related for Buyers & Sellers:

Adam's Aerials (for buyers & sellers)

Comments