Mortgage Lender Recommendations

- Adam Garrett

- Jul 14, 2023

- 4 min read

Updated: Sep 8, 2025

In this article, I wanted to go over specific lenders that I recommend that you consider for your home purchase. Keep in mind that the lenders I would recommend for manufactured homes, mobile homes, land, construction to perm, and commercial real estate typically differ than my recommendations for typical home mortgages.

Disqualification from Incentives Unless You Follow Lenders' Rules

With some of the below, there are referral incentives to use a lender via my referral that is no longer possible unless going through the right access channel. Those referral incentives are purely for your benefit. I get nothing but a happy client. In the case of affiliate lenders, while I don't get any financial compensation directly, compensation to my company helps my company stay in business & mentioned options like with Garrett Mortgage are typically unavailable with most lenders.

Affiliate Lender Recommendation:

Mike Hartnett: Experienced & Reliable

Mike Hartnett One Presidential Mortgage Offers some programs that others don't, including solid grant programs with FHLBank Atlanta.

Phone: (757) 344-3366

Non-Affiliate Lender Recommendations:

Lender (online) offering $2,000 in closing cost assistance for every $100k in cost, up to $10k for my referrals

For this one, it's important to not reach out to them pre-emptively prior to my formal referral. If you do, you could become immediately ineligible for the incentive.

Other Lender (ask me their name since I shouldn't publish it) - $1,000-$2,000 in closing cost assistance for every $100,000 in cost, up to $5,000 or 10,000, for buyers I refer to them without having any negative impact on the rate. I need to directly add you to a portal to acquire this assistance. One buyer with an over $500k preapproval missed out on this incentive because they reached out to this lender without my referral introduction. There is no income limit so if you're buying a >$500k home it might save you $10k.

$500 savings via My Referral w Another Lender

For this one, it's important to not reach out to them pre-emptively prior to my formal referral. If you do, you could become immediately ineligible for the incentive.

Lower (online)- No hard pull for a quote & low-cost refinances

Lower- I really like Lower, enough that they're 1 of the 3 lenders that I did a hard pull with in 2021 for a mortgage. They offer a quick initial application, low rates, no hard pull for a quote (which is rare for lenders, though keep in mind that the interest rate after a hard inquiry could be significantly worse in some cases), are textable on weekends (which is rare for online lenders), don't have the delays common among online lenders, & I can vouch for them to listing agents in a way I can't with other online lenders because of all of the business that I have done with them.

One of the best aspects of Lower is the low-cost refinance options with them. You'll still have some title fees, but Lower itself doesn't charge for refinances after 6 payments, significantly reducing the cost of a refinance. If you expect that you'll be doing a refinance in the future (i.e. if rates lower in the future substantially), that's important.

Keep in mind that they don't allow escrow holdbacks or reno loans and don't do VHDA loans at the time of this writing.

Steven Carpel - reimbursement for credit repair

Steven Carpel

Mortgage Banker

Offers some programs that others don't, including a reimbursement of the first 4 months of paid credit repair with 1 company at closing.

Phone: 757-921-1387

Email: StevenCarpel@gmail.com

Lori Marrow - mortgage broker with many programs

Lori Marrow Mortgage Broker She offers some programs that others don't. At times she has offered 0% down VA construction loans and 3.5% down FHA construction loans, & a 2.75% interest VA mortgage for someone with a <620 credit score for instance.

Phone: 757-870-0231

Email: lorimarrow@live.com

NMLS: 174955

Address: 742 Thimble Shoals Blvd

Newport News, VA 23606

NASB (online)- quick to respond

North American Savings Bank For an out of town lender, they are a good option. In my experience, Jeff had good response time and low rates (VA in example of buyers that used them). His many excellent reviews are warranted in my opinion.

Phone: 816.508.2244

Email: jmcmillin@NASB.com

Jeff McMillin

903 E. 104th Street, Suite 400

Kansas City, MO 64131

English & Indian Speaker: JiJi George: Speaks English & Indian languages including Hindi, Urdu, Malayalam, Punjabi, Tamil, Bengali.

JiJi George

Mortgage Loan Originator

Speaks English (full professional proficiency) & Indian languages including Hindi (full professional proficiency), Urdu (limited working proficiency), Malayalam (limited working proficiency), Punjab (elementary)i, Tamil (elementary), Bengali (elementary).

Phone: 804-454-5527

Non-Affiliate Non-Profit/Government Recommended Lenders (Buyer Beware):

Lender (nonprofit) with better rates & rate buy down option than any on this page & where credit score is not considered (but takes longer than any other mentioned options & some above median income households will be restricted to buying in below median income areas)

Program where I am not supposed to publicly advertise their name due to a rule of theirs that offers better rates more effectively possible than any lender above:

Expect the most demanding time needed to get approved out of any other lender above, with the worst reviews of any lender above, but also typically better rates (including less than <.5%) for lower costs possible than any lender above through their unmatched rate buy down features with starting below market interest rates, especially for those below median income for their household size. Also, these loans have no income limits in large below-median income areas (even 1% below median) and credit score is not considered. For those with plenty of funds for a buy down or even those without, this option is a solid one since the seller can buy down the rate very often, especially in light of the "no closing costs" & no down payment requirement. In addition to being time consuming to acquire, there is a little annual volunteering needed for the life of the loan, however means of volunteering include as easy of measures as sharing about the program on social media.

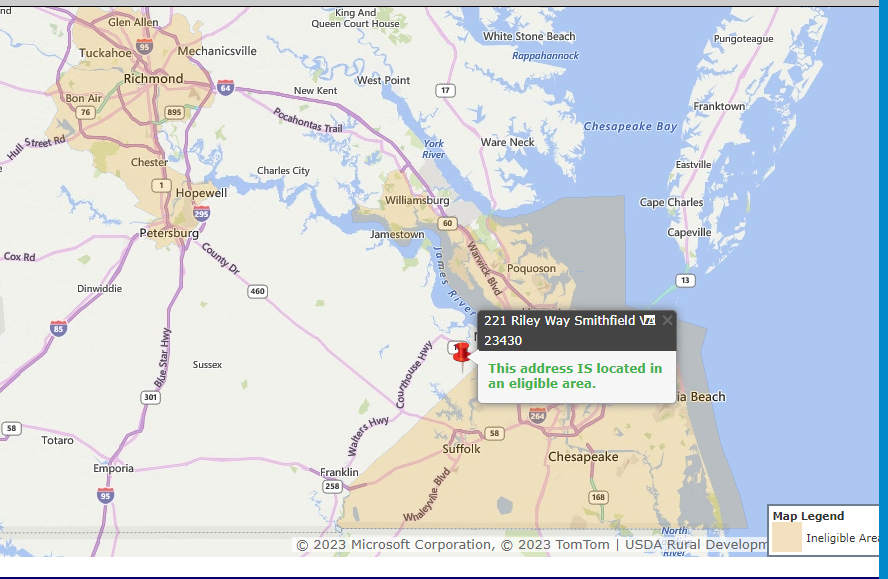

USDA Direct Loan at 4.125% Rate up to 38 Years or 1% Interest Rate up to 38 Years

Check your eligibility by income etc.

Lenders to avoid:

Related:

Comments