Earnest Money Deposits

- Adam Garrett

- Sep 11, 2023

- 11 min read

Updated: Sep 25, 2023

The earnest money deposit keeps the buyer honest and it's something that is a recourse for the seller to use if the buyer does something in breach of contract (most typically, withdrawing from the contract outside of contractually allowable contingencies) that could cause the seller financial harm.

EMD Basics:

Why EMD?

The EMD (Earnest Money Deposit) tends to keep buyers honest, since if the buyer does something outside of the bounds of the contract, that has a substantial negative financial impact on the seller, the seller can sometimes take the EMD. An example would be if a home had a home inspection contingency for 14 days, and the buyer said that they wanted out of the contract after 14 days. Rather than going through the hassle of a lawsuit, an easier option for the seller would be to ask for the buyer’s EMD. With some banks selling foreclosed properties, there is an automatic provision for situations like this one stipulated in the purchase agreement (such as HUD). I personally have never been involved in a transaction where the buyer’s EMD (if I was representing the buyer) has been taken in my years of real estate, but it does happen (& I’ve seen it happen to the other side of a transaction when I was representing the seller and the buyer was in breach) in some cases when the buyer is doing something that costs the seller money. Taking a home off the market from other prospective buyers, especially when the moving process etc. has started, can cost sellers substantial amounts of money, so it is very important to stick to the contract in order to avoid a lawsuit (the EMD isn’t the limit of liability for a buyer if they cause a financial loss to the seller & the seller refuses to sign off on the release and hold harmless language that comes in a typical release of EMD to the seller) &/or a loss of all or part of your EMD.

When Can the Buyer Lose Their EMD?

1. A buyer tries to walk during an occasion when it is in breach of contract to do so (i.e. if they got cold feet or turned in home inspection requests after the deadline to do so & the seller doesn't budge on the deadline).

2. A buyer performs a discretionary job move or purchase, jeopardizing their ability to pay for the home. Before anything like that, be sure to speak to your lender.

3. A buyer performs misrepresentation or fraud at time of loan application & that misrepresentation or fraud later disqualifies them for the loan.

4. A buyer is lackadaisical on performing to the terms of the contract and is unable to close on time due to their gross negligence (not typically due to the fault of the lender or due to the fault of the seller, where buyers often won't lose their EMD), and the seller would prefer to terminate the contract rather than extending it and trying to drag the buyer along.

EMD Isn't the Limit of the Buyer's Liability

If a seller accepts a contract without an EMD, or even if the buyer provides a big one, that doesn't mean that it's the limit of the buyer's liability. In some cases, the amount of financial loss by the seller can be much greater than the EMD amount, and the seller is able to pursue the buyer for an amount greater than the EMD in court or via arbitration (depending on contract terms) by having grounds to refuse to sign off on a release (including the hold harmless language within it beyond the EMD amount) & proceeding to not sign it.

In some cases the seller has contractual grounds to terminate & put the home back on the market without the release being signed. See REIN standard purchase agreement section 18: Default, which states, “the defaulting party shall be liable for the brokerage fee due listing firm and selling firm. In any action arising from or related to this agreement, including, but not limited to, any suite to secure the release of the deposit from escrow, the prevailing party shall be entitled to receive from the non-prevailing party or parties, reasonable attorneys’ fees, costs (including expert fees), and expenses incurred by such prevailing party.”). Those fees can also include any difference in purchase price between your contract and the next contract (& I’ve seen this difference alone be as much as $12,500 after a buyer walked the week of closing due to her financing being bad despite having a preapproval due to not paying her taxes for years prior. I was representing the seller and we did get a lawyer involved when the buyer was refusing to cooperate or be forthcoming).

Getting Your Money Back

In most cases (see item 1 for exceptions), you will get your money back from the EMD as either a credit toward your closing costs/prepaids, down payment, &/or as a direct refund to you. If you didn’t make an offer or made one that fell through (& we’ve gotten a release signed from the seller, which can take a few days sometimes & more rarely, up to a week) & you’re local, you can typically get your money back picking it up at the office within 2 business days of request. It can also typically get into the mail system within 2 business days of request. If you need it more quickly, just let me know as it can be expedited to less than 1 business day. Wires going out and ACH transfers going out are also possible from the GRP end within that time (though the timing of wires and ACH transfers being received by you can vary).

“If the transaction does not close, funds must be held until: all parties

agree upon the disbursement; court order; interpleader (funds handed to the court

until dispute is settled); or until the principal (or supervising) broker follows the

terms of the sales contract (requires written notice to non-receiving party, with 15

days to protest).” - Moseley section on law

Customary in VA, Not a Legal Requirement

No earnest money deposit is legally required in the state of VA. That said, it is a customary aspect of the vast majority of real estate transactions and sometimes sellers will list a required minimum amount. If you don’t provide an EMD, rejection of your offer is a much stronger prospect and the seller will likely have fear of your financial situation. Sometimes buyers who are barely able to pull off a purchase aren’t able to pull it off at the last minute, and you don’t want to appear like that. Also if you have no EMD, the seller has no easy means of keeping you honest if you breach the contract.

Amount

In our market you can sometimes get away with $500 or $1000 for properties below $200,000 in single offer scenarios (and sometimes more than 200k), especially where that amount would be 1% or more of the purchase price. In order to make a stronger offer, it is better to have at least 1% rounded to the nearest $500. In some cases closer to 1% is required and in some cases I have advised buyers to have an earnest $ deposit of 10% or more. In competing offer scenarios, this can be helpful as yet another reason for a seller to accept an offer. Sometimes sellers receiving multiple offers will just pick the best one rather than asking for highest and best or otherwise creating a bidding war. Whether in a bidding war or not, a higher earnest money deposit does make the offer more tempting for the seller to accept. It shows the buyer's commitment to purchasing the property as well as the buyers resources available. Those with small earnest money deposits usually have such small deposits because of their limited resources and savvy sellers know this. It is more likely for those with smaller earnest money deposits to have lower credit scores, incomes that might barely be sufficient for the loan, and otherwise tend to be more problematic buyers who have a higher likelihood of eventually not being able to qualify when it comes to closing time. Private sellers care more than banks about the amount of the EMD. Banks seem to care less about larger EMD’s except in some cases where they require larger amounts such as 10%.

In some cases, a minimum EMD is specified, & that depends largely on the MLS used. In CVR MLS, there is a specific location on the listing for agents to specify the minimum EMD, whereas in REIN, there isn't a specific location for it, so if it's added, which is much rarer than CVR because of the absence of a specific location for it, it's in the agent remarks typically.

Also, if a 1% EMD or a larger EMD means that you will be stretched financially, it is important to tell that to your buyer’s agent.

Keep in mind that the EMD will be deposited after contract ratification so if using a check, make sure that the money is there. Also keep in mind that other funds will be needed in the home-buying process, like home inspection costs, appraisal costs, & more.

With HUD properties, $1000 will be sufficient in most cases and is required for properties listed above $50,000 at the time of this writing.

Keep in mind that EMD minimum requirements can be 10% for some cash sales (i.e. some auctions).

For Ryan Homes, last time I checked they require 2% for VA, 5% for FHA, & 8% for conventional EMD's within 45 days of contract ratification.

Forms of Earnest Money Deposit

Because the form of the EMD is typically laid out in the contract, & changing that after the contract is ratified would require a contractual amendment signed by both sides, it’s best to figure out what method you’ll choose prior to time of offer.

In most cases a personal check is fine. In some cases, such as with HUD properties and some other foreclosures, a cashier's check is required. Either way, there are free options available. Free personal checks can be found with many online banks like Discover Bank for free checkbooks & many other institutions including bricks & mortar banks/credit unions for free sending of 1 check in the mail at a time with a specific amount and recipient in mind. Some accounts like my Preferred Checking account with Wells Fargo offer free cashier's checks & free money orders although it’s not their most basic account & my particular account is discontinued from new applicants in the area at the time of this section’s writing (7/16/21). Portfolio by Wells Fargo is their currently available local option as of July 21 for that though to avoid the monthly fee you’ll need $20k in linked accounts. Through my banking with Discover, Capital One, Alliant, Bank of America Relationship Checking Account, & more I have free personal checks.

Money Orders, ACH Transfers, and wire transfers are also options. ACH transfers are often cheap or free, while wire transfers are typically not, but ACH transfers typically take more time than a wire transfer. Some ACH transfers are faster than others, with the quickest I’m aware of being the next business day. Some banks like some accounts with Fidelity & Synchrony offer free wires (I have 3 free wires/month w Synchrony since I've had an account with them for over 5 years). Ask Adam for the wiring instructions (which are also helpful for ACH transfers) IF the EMD holder is Garrett Realty Partners.

Holder of EMD

If the seller does not state a preference, we usually like to have Garrett Realty Partners to be the EMD holder. Sometimes, the sellers will want the EMD going to their own real estate company’s escrow accounts, and sometimes, banks will want the EMD going to the buyer’s closing company.

EMD Details for Turning in 1:

Location of EMD on Contracts in SE VA

The earnest money deposit amount is located on page 1 of the REIN standard purchase agreement & pg 2 of the VR Residential Contract of Purchase.

The VR agreement has language prohibiting reproduction, but in the case of the REIN contract, see the "EMD Terms in REIN Offers" for an example.

EMD Memo

The EMD memo line depends on your preferences & location,

If it's a check, I generally recommend it simply saying "Earnest Money Deposit" as long as you have a separate note that you can put with it (in an envelope that includes the check) of the buyer's agent's name (i.e. Adam Garrett if I'm your agent).

If it's a wire or ACH transfer, it's best to include the property address in any memo.

Take a Picture or Screenshot

A picture of the EMD (or screenshot if an electronic transfer) is best to be submitted with any written offer. Be sure to take a picture or screenshot prior to putting it in the mail & sending it to me (or whoever is going to hold it) if you are an out-of-towner or looking to avoid a drive. That said, be sure that however you get it to the respective party, it's done in time according to the contractual deadline.

Timing for EMD

With REIN offers, in most cases you’ll need to turn your EMD in within 2 business days of contract ratification after both the buyer and the seller mutually agree to an amount and terms and have all that in writing unless you modify the REIN contractual template.

Because of the short timeline on EMD's, it is a good idea for out-of-towners purchasing sight unseen to mail in personal checks in advance in order to avoid the fee from a wire transfer as long as a cashier's check is not required (i.e. required with HUD homes) & as long as they don’t have a bank account with free wire transfers (i.e. Synchrony bank after 5 years of holding an account which includes 3 free wire transfers/statement).

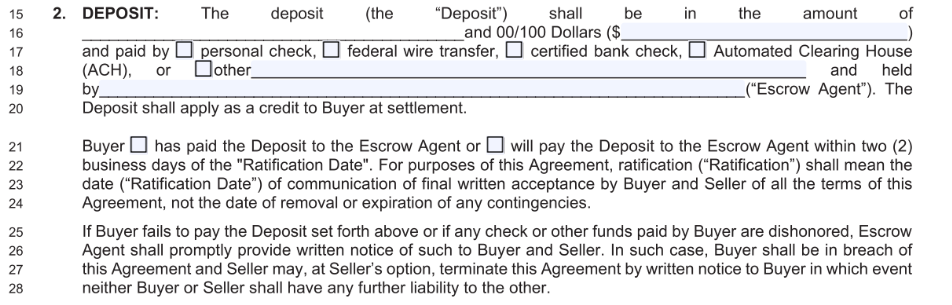

EMD Terms in REIN Offers

The EMD terms directly from the standard purchase agreement at time of original writing most often used where we usually check the box for “will pay…”:

EMD Drop Off & Mail

Whether dropping off or mailing it:

In an envelope, be sure to include a personal check, cashier's check, or money order(s) (whatever the contract terms stipulate) along with a note that includes your buyer's agent's name, the address of the property, your name (if not present on the check), & your best contact # (ideally textable).

A. If the EMD is due to another office, and you haven’t provided it to Adam prior to contract ratification, it’s best to hand-deliver it to the office where it’s due directly unless time permits for it to be mailed.

B. When the EMD holder is Garrett Realty Partners or Closing Edge Title:

Our office where we take EMD's is located at (front of envelopes w EMD's for drop off or mail):

MLS Desk

11864 Canon Blvd Suite 103

Newport News, VA 23606.

For more details on drop-offs at Garrett Realty Partners, see:

Garrett Realty Partners Corporate Office

In particular, see "If Meeting with Adam or Dropping Off Something for Adam"

EMD Wires

Adam can provide you the information on EMD wiring instructions if the EMD holder is Garrett Realty Partners.

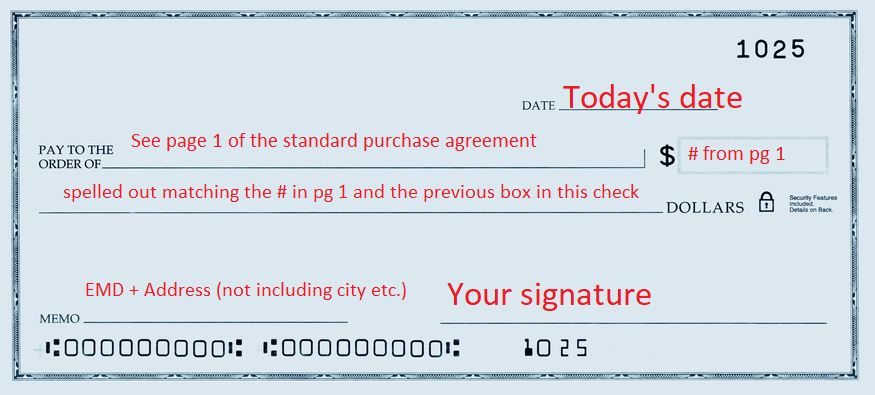

How to Fill Out an EMD Check

The first step to filling out an EMD is acquiring the right check(s) if you don’t already have them. On pg 1 of the REIN standard purchase agreement for a home sale (pg 2 of the VR Contract of Purchase) it states whether you’re acquiring a personal check, money order, cashiers check, or otherwise. It will state the amount needed and who it should be paid to. It’s important to have this money in the bank prior to giving it to me because it will be deposited. It’s also important to do it within the timeline of the contract (typically within 2 business days of ratification). If it’s a cashiers check or money order you’ll need to instruct the bank or the other location that you’re purchasing it from.

You can acquire personal checks in any of the following means typically:

a. Directly with your bank/credit union in person if there are nearby institutions (or in some cases, partner institutions).

b. Directly with your bank/credit union by mail (if doing this method you should do it prior to writing an offer)

c. Through third parties like Walmart.

3. In red is the information that you need to input if using a REIN Standard Purchase Agreement, although see above on whether or not to input the address in the memo under "EMD Memo":

(with VAR offers, see page 2 of the purchase agreement for the EMD recipient & amount)

An example of the above IF the EMD holder is GRP, a personal check is what's required in the contract, and the EMD amount is $10k:

Related:

Comments