Assumptions

- Adam Garrett

- Feb 24, 2024

- 1 min read

Updated: Mar 5, 2024

A typical assumption in real estate is where a buyer assumes a seller's loan at the time of sale, often at a lower interest rate than the current prevailing rates. Some loans have assumptions as an option and some do not.

For Buyers:

Benefit to Buyer

The main draw of an assumption is that you're able to purchase at a rate that is lower than prevailing rates. When you wouldn't be, there would typically be little reason to acquire an assumption.

Purchase $ or Financed Gap Coverage Needed for Buyers

With an assumption, the buyer would typically need to pay a lump sum for equity when assuming the mortgage (the difference between the purchase price and the assumed loan amount typically). While there are sometimes (rarely) options for financing the gap, the interest rates are higher than a typical mortgage for the gap and they aren't often done. That said, by knowing the right things to look for, you can make your chances a lot better.

"Assumption Solutions refers to the difference between the purchase price and the assumable mortgage amount as the “assumption gap.” In theory, that gap could be financed but, since buyers are being qualified by the existing mortgage servicer, any additional financing may affect the buyer’s ability to get approval to take over the mortgage. O’Boyle says, for almost all the files processed by Assumptions Solutions so far, the gap has been covered with a cash down payment. Every buyer who has tried to finance the gap has been denied by servicers."

In my opinion, one of the top reasons why they aren't often done is that buyers aren't looking for the right set of circumstances needed for gap financing to work. Those circumstances include:

Finding a 2nd mortgage lender who is able to do 95% loan to value ratio on the home when the interest rates aren't much higher than traditional rates before attempting to finance that or more with the lender of the 1st mortgage. Many buyers' agents and fellow lenders are unaware of such lenders (I was too until recently) existing, and many buyers give up that search too early. I won't post their names here since high demand recently increased their prices.

Look for the right set of circumstances with the loan, including:

a home that owes an amount not far from the prospective purchase price (i.e. 10% below)

a significantly reduced interest rate vs the going rates (i.e. half the current rates)

While some loans will still be doable, a plus is a property where you can afford it without an assumption

While some loans will still be doable, another plus is a property where your affordability without an assumption isn't maxed out

Very often, all people look for is the low rates, without enough focus on the other factors.

Risk to Buyer

While there are other risks associated with mortgages options like assumptions that aren't true assumptions, one of the main risks for true assumptions is time. You could spend months waiting to hear back from a lender on an assumption only for them to reject it & then deny an appeal.

For Sellers:

Main Risk to Seller

It can be risky for a seller, because with some assumptions, if the buyer defaults, it can come back to haunt the original borrower in some cases. Whether it will or not if that happens depends on the terms. In some cases, there can be essentially a guarantee that it won’t come back to haunt them, even in event of default. You should consult legal advice rather than relying exclusively on what someone with the mortgage company says.

The other main risk with assumptions is time. You could spend months waiting to hear back from a lender on an assumption only for them to reject it & then deny an appeal.

Risk to VA Sellers

If a VA borrowing seller let’s a non-VA borrower assume his mortgage, it negatively impacts future entitlement for VA loans. Conversely, when a VA borrower assumes another VA member's mortgage, that VA borrower is able to use their own entitlement.

Benefit to Seller

The positive of an assumption is that it can make a home sale more attractive. If it was me, I would be hesitant to offer it as a seller unless I had a guarantee that it wouldn’t come back to haunt me. If I had that guarantee, the fact that buyers might be willing to pay a significant amount more for the sale to make the risk more worth it for the seller would be appealing. Sellers can be restrictive based on credit worthiness for who they accept to assume their mortgage if default would hurt them. In a multiple offer situation, one nice thing about an assumption offered is that it could get other parties to bid higher who wouldn't be assuming it. If the party with an offer for an assumption didn't make the risk worth it considering the assuming buyer's credit, you could select another party at a potentially higher cost than you would otherwise.

Types of Loans for Assumptions:

Government Loan Types w/ Assumable Clauses: VA, FHA, USDA

"Currently, the only loans with a standard qualifying assumption clause are VA, FHA and USDA loans."

"VA, FHA and USDA mortgages all carry a qualifying assumable clause, which means any owner-occupant buyer can qualify using the same standard the loan was issued under with the existing mortgage servicer. Investors cannot assume these loans."

"Anyone can assume VA loans – even buyers who haven't served and aren't otherwise qualified for a VA certificate of eligibility. However, most owners won’t agree to this, since it ties up their VA loan entitlement."

Most (But Not All) Conventional Loans Aren't Assumable

"While they will not apply to the vast majority of transactions, there are certain situations where conventional loans are indeed assumable.

The most noteworthy instance is in the event of inheritance or divorce. The Garn-St. Germain Act of 1982 made it simpler for individuals to assume a conventional loan when inheriting a mortgaged property or when awarded sole ownership as part of divorce proceedings.

Though far less common than fixed-rate loans, conventional adjustable-rate mortgages (ARMs) are usually assumable. They can't, however, be assumed in their initial fixed-rate period or after being permanently converted into a fixed-rate mortgage. Plus, assumed ARMs aren't eligible to be converted to a fixed rate. These restrictions leave little incentive for buyers to assume an ARM, especially if interest rates continue to rise."

USDA Assumptions (Typically Current Rates, but Lower Closing Costs)

"You can usually assume a seller's... USDA mortgage...USDA loans have more stringent requirements.

Assuming a USDA loan also readjusts the payments to reflect current interest rates in most cases. This defeats much of the purpose of assuming a low-interest-rate loan. This option does, however, still offer the benefit of reduced closing costs."

Other Elements of Assumptions:

They Take Longer

Assumptions take longer typically than a traditional loan to close. According to American Financing, "the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you’ll have to wait to finalize your agreement."

New Way Mortgage even states that they can take up to 6 months.

Rick Elmendorf, Branch Manager & SVP of Mortgage Lending at Guaranteed Rate, states, "a mainstream lender quoted recently that the 'average VA assumption take about 60 days'!"

Sometimes after a long wait (i.e. months), an assumption will be denied. If you're denied, I recommend appealing the decision before quitting if possible. Here's more on that in article.

Closing Costs Involved

According to the Mortgage Reports, "You’ll have to pay closing costs on a loan assumption, which are typically 2-5% of the loan amount. But some of those may be capped. And you’re unlikely to need a new appraisal. So you may pay less on closing than a ‘typical’ home purchase — but only a bit less."

Not All Lenders Do Them (Disputed)

Lending Tree states the following:

"Are FHA loans assumable?

Most government-backed loans, including all FHA loans, are generally assumable, as long as the lender approves the sale. However, additional rules apply:

→ For loans originated on or after Dec. 15, 1989: If the buyer is creditworthy, the lender must approve a sale by assumption and transfer responsibility to the buyer. Loans issued before that date may be assumable, but the lender isn’t required to release the seller from liability.

→ Under special circumstances (such as death and inheritance): The lender isn’t entitled to check the buyer’s creditworthiness in cases of death or inheritance, and doesn’t have to approve the sale."

"All VA loans are assumable, but with additional rules and requirements that govern exactly how:

→ Loans originated before March 1, 1988, are “freely assumable,” which means the assumption doesn’t have to be approved by anyone.

→ Loans originated after March 1, 1988, are assumable as long as the lender approves and the buyer is deemed creditworthy and pays a processing fee."

"If the loan was closed before March 1, 1988, the lender’s approval is not required as these loans are freely assumable. However, if your loan was closed after March 1, 1988, you must get in touch with a VA-approved private lender who can work with assumable mortgages."

Not all lenders agree. Military Officers Association of America states the following, with an opposite shift supposedly occurring in 1988:

"Any VA home loan entered into after 1988 can be assumed by another buyer. This means a borrower can take over the terms of the existing VA mortgage, even if they are not eligible to take out a VA loan themselves."

Rick Elmendorf, Branch Manager & SVP of Mortgage Lending at Guaranteed Rate, states the following:

"Perhaps the biggest roadblock to assuming a VA loan is the Lender. Not all lenders will do assumptions, period. So, if the loan is being serviced by one of those lenders, you are out of luck. The issue I'm seeing is that many Sellers think that just because they have a VA loan that it's automatically assumable. That's not true... the lender can simply say 'no' and, by the way, they do. On top of the high number of lenders that won't even do a VA Assumption, according to HMDA data, over 12% of VA loan assumption applications received a denial in Q2 of 2022."

Alternatives to Assumptions

"Closing Cost Credits

The most straightforward alternative to get below-market rates when the seller has a non-assumable loan is to ask for a closing cost credit. This credit can then be used to buy mortgage discount points.

These points generally cost 1% of the loan amount and reduce the mortgage's interest rate by 0.25%. Lenders usually allow buyers to purchase up to four discount points, equating to a roughly 1% rate reduction.

Seller Financing

Although it's far less common than in years past, rising interest rates have made it practical for some property owners to offer seller financing. Seller financing can come in several forms, including traditional owner financing, wrap-around loans, and seller carrybacks.

Traditional owner financing is when the seller owns the property outright and is willing to finance the entire loan amount for the buyer. This situation offers the buyer and seller the most freedom to negotiate mutually beneficial interest rates and loan terms.

A wrap-around loan occurs when a property owner has an existing mortgage with a balance less than the home’s market value. The seller would then finance the buyer’s loan, using part of the monthly payment to pay their existing mortgage while keeping the remainder as proceeds.

Buyers need to use extra caution in this situation to ensure the seller's original mortgage allows for a wrap-around transaction. If not, the original lender may choose to foreclose on the home, with the buyer having very little recourse.

Seller carrybacks are when the property owner agrees to hold a secondary mortgage, allowing the buyer to take out a reduced loan at current market rates. Lending guidelines for these owner-carried second mortgages vary, but conventional loans allow sellers to charge 2% less than standard interest rates."

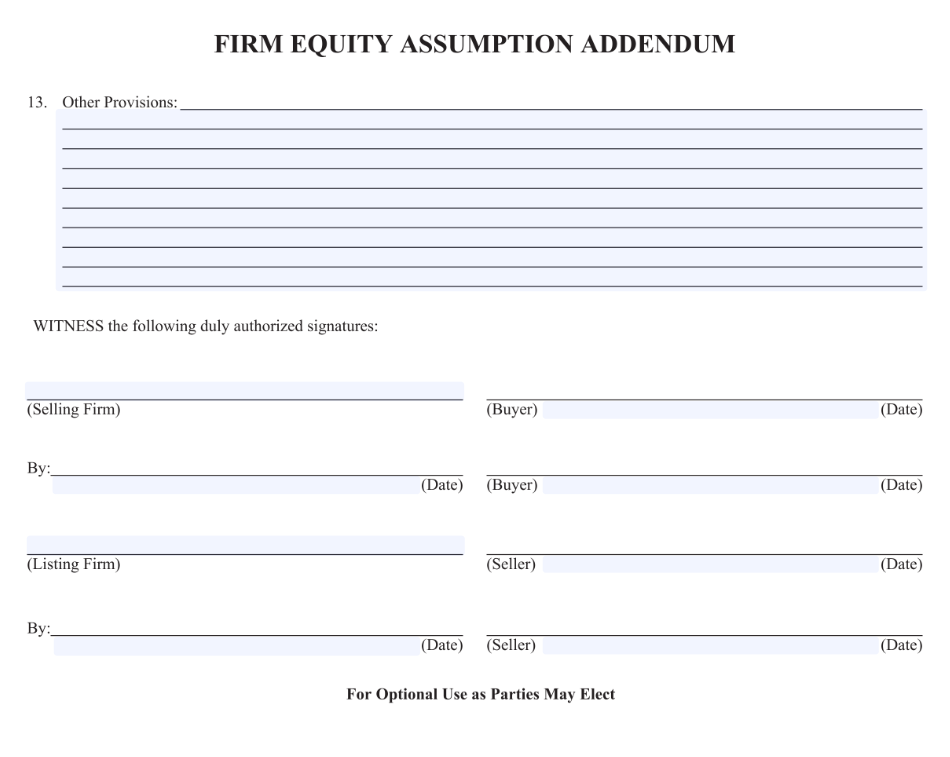

(Hampton Roads) REIN Assumption Addendum

The assumption addendum used primarily with REIN Standard Purchases Agreements, with REIN being the main MLS in Hampton Roads, is below:

Initial Items:

Terms:

Additional Terms & Signatures:

Images courtesy REIN

Getting Help on an Assumption

Just like getting help for a short sale is warranted with a 3rd party specialist, getting help with an assumption can be very beneficial for buyers and sellers. There's a company that serves all 50 states that currently charges $550, Assumption Solutions, that's featured in the NAR article I reference elsewhere in this article.

Related:

Popular Posts Loosely Related:

Comments