Rent To Buy/Own

- Adam Garrett

- Aug 5, 2023

- 1 min read

Updated: Jul 3, 2024

Renting to own sounds nice, but when you get down to it, there are a lot of issues present. In some cases, it can be a good fit if you find the right home, & it doesn't hurt to inquire of properties for rent or sale if they're willing to do a rent-to-own situation, but for most, the traditional route of renting one home and buying another will be better, & many who attempt to find a rent to own never find it & waste a lot of time doing so.

Very Limited Inventory for Rent to Own

The number one problem with renting to own is finding properties. If you go on rent to own websites, the inventory there is drastically less than that which is available for sale or for rent in the same location. Most people either want to rent or they want to sell. Slim pickings mean you'll likely need to make a lot of compromises, some that could hurt you, in order to fit a square peg into a round hole.

Some of the Information out There About Rent to Own is Inaccurate & Portrays it More Positively Than it Really Is.

For instance, at the following website (where comments are only allowed by moderation - which is something to look out for since when that happens people don’t have peer review of experts holding them accountable):

https://investorjunkie.com/real-estate/rent-to-own/

It compares a traditional mortgage with rent to own. It makes the traditional mortgage look worse than it actually is. For instance, it doesn’t mention that the PMI, property taxes, homeowners insurance, & mortgage interest are part of the mortgage and that with VA mortgages, NACA, or some conventional no money down mortgages, there is no monthly PMI. Also the % is not even accurate and is less than the actual percentage of the mortgage. They don’t mention that the closing costs can be paid entirely by the seller or mostly by the seller in most cases. They say that a requirement for a purchase is “very good credit score” & other requirements that are misleading. There are mortgages available for those with a credit score of less than 600, & NACA (below) isn’t the only one. With the timeframe, they don’t mention that most people DON’T live in their home for 30 years, with most opting to sell far beforehand even though in an ideal scenario living there throughout your mortgage is ideal. They also don’t mention that some mortgages are less time. My brother has a mortgage that’s less than 10 years, for instance. The down payment can be as little as nothing with certain mortgages such as NACA or Garrett Mortgage.

Here's another article example:

https://www.investopedia.com/updates/rent-to-own-homes/

This article isn't as biased, but still, I completely disagree with the idea that "A rent-to-own agreement can be an excellent option if you’re an aspiring homeowner but aren’t quite ready, financially speaking." It's a viable option, but certainly not an "excellent" option.

Where NOT to Find Rent-to-Own Properties

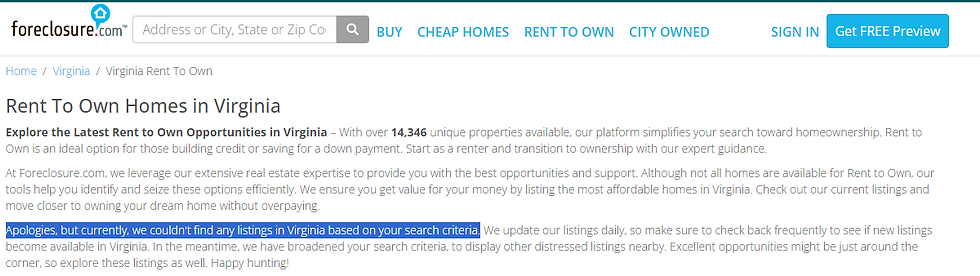

I do not recommend the following websites, where the vast majority of "available properties" aren't really available as rent to owns in Virginia:

https://www.foreclosure.com/rent_to_own/ (no properties throughout VA as of 7/1/24)

https://homefinder.com/rent-to-own/VA (paywall & list of homes mostly not really available for rent to purchase)

The descriptions tend to begin:

"This property is for sale and a "Rent to Own" financing option may also be available for qualified buyers."

I was able to match a home here that had expired. It wasn't for sale and was never listed for rent to own as far as I could tell. There's also a registration paywall for more information.

https://www.housinglist.com/rent-to-own/va (registration with agreement to be contacted required & list of homes mostly not really available for rent to purchase)

I was able to match a home here that had sold just a few weeks ago. It wasn't for sale and was never listed for rent to own as far as I could tell.

Where to Find Rent-to-Own Properties

If you're set on finding something rent to own, there is minimal inventory, but I recommend starting with the following dedicated to renting to own:

REIN MLS (for those in Hampton Roads) from an agent portal:

Add criteria: "Lease Conditions" is 'Buy Option'

Keep in mind that in a test in 7/2/24, only 5 homes throughout Hampton Roads (896 homes) were populated. That's .56% of homes.

2. On the CBRAR/CVR MLS front, no homes out of 172 properties fell under the "Lease with Buy Option YN" criteria under Y.

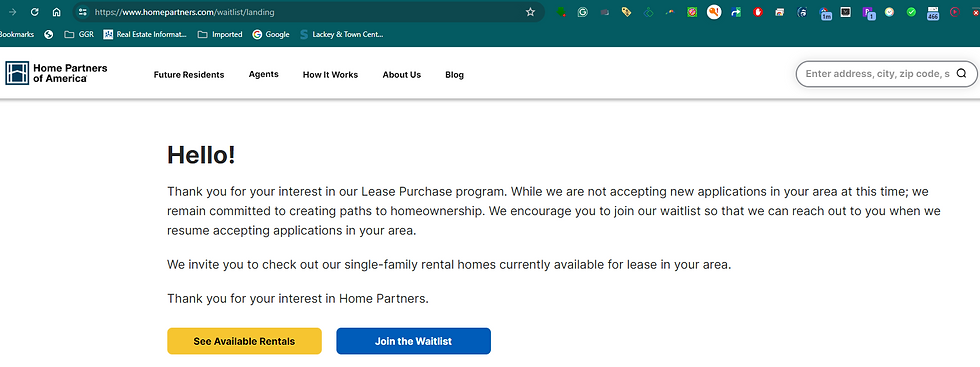

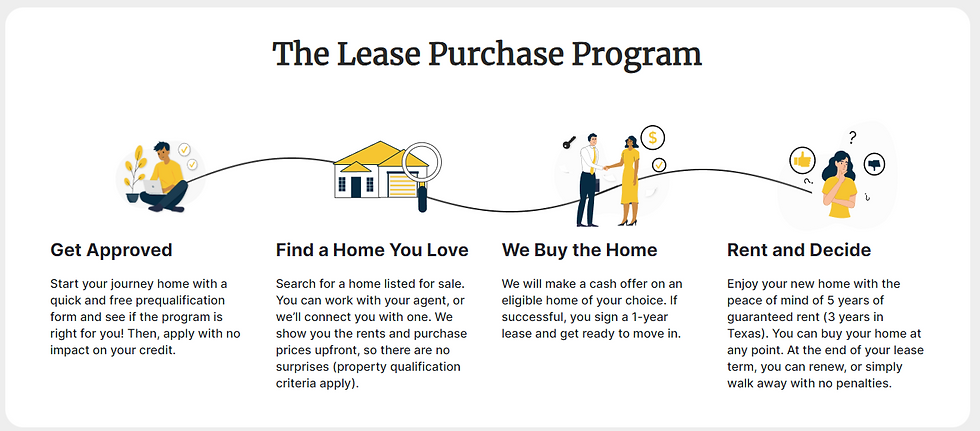

Home Partners of America (Richmond MSA & Select Other Markets)

Home Partners of America is currently (as of 7/2/24) a viable option in the Richmond MSA it looks like, with 36 eligible properties.

Here are their other markets currently:

3. You can also contact the owners if unrepresented & property managers/listing agents if represented of either homes for sale &/or homes for rent to see if any of those are interested in a rent-to-own option.

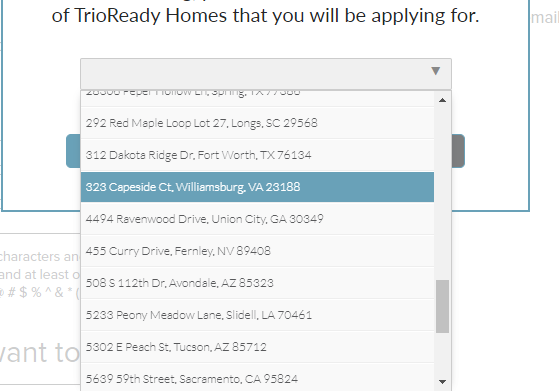

Where to Find Rent-to-Own Properties in Certain Other Locations Excluding SE VA

Dream America (in FL, GA, & TX as of 7/2/24)

Credit's Impact & Workaround Solutions

Whether you're buying or selling, your credit matters in the vast majority of cases.

Here is information on boosting your credit. For those looking to purchase in the future with Adam, he offers free credit assistance. If you're not in Adam's coverage area, here are options for free credit counseling in Virginia & here is a directory for other states.

Some lenders have different requirements than others. If you get rejected by 1 lender, don't assume that all lenders will reject you based on credit. For instance, with NACA, credit score isn't even considered, though they do still have minimum requirements regarding certain factors impacting credit.

Related: Renting When You Have Low Credit or Eviction History

Down Payments & Workaround Solutions

There are many options to buy for those without a down payment that many are unaware of. VA loans and USDA loans aren't the only options out there. Likewise, there are options to buy with minimal up front other costs, whether because the seller covers those costs, whether a loan type has minimal costs (i.e. NACA & USDA direct), or because a program to reduce home cost covers them.

Adam also offers free budgeting assistance to those looking to purchase with him in the future. Here are some of his $ saving tips, here are more related to taxes, here is Assistance with Utility Bills, and here are some tips from Need Help Paying Bills.

Related:

Comments