Why Should Sellers Avoid Offering Low or No Buyer's Agent Commission?

- Adam Garrett

- Apr 6, 2024

- 8 min read

Updated: Nov 18, 2025

Image courtesy Housingwire

Did you know that it's possible as a seller being represented by a listing agent (or a seller representing themself) to provide no buyer's agent commission? While that's been possible for years, following the NAR settlement, now it's official & a lot more people know about it. However, doing so substantially lowers your buyer pool and the agents that will push your property to their buyers, so I allow it if a seller wants to, but it's not something I typically recommend. Per NAR's 2023 Quick Real Estate Statistics available in 2024, "89% of buyers purchased their home through a real estate agent or broker." Most of them didn't pay their buyer's agent's commission, but if you don't, they may need to if they want to buy your house, and if they don't want to, they may not even see your house, even if their buyer's agent is following their orders and doing things ethically.

NAR Settlement Impact

Some are heralding the recent NAR settlement as a new era of low real estate agent fees, but before the settlement ever occurred, people didn't have to use real estate agents to sell, and discount listing agents existed that cut corners in various capacities in order to accommodate higher volume with reduced quality. While there's long been the perception that real estate agents make too much money, according to NAR, the median real estate experience of REALTORS® is 11 years, and "The median gross income of REALTORS®—income earned from real estate activities—was $56,400 in 2022".

Here are some of the main impacts of the recent NAR settlement on commissions:

"NAR has agreed to put in place a new MLS rule prohibiting offers of broker compensation on the MLS. This would mean that offers of broker compensation could not be communicated via the MLS, but they could continue to be an option consumers can pursue off-MLS through negotiation and consultation with real estate professionals. Offers of compensation help make professional representation more accessible, decrease costs for home buyers to secure these services, increase fair housing opportunities, and increase the potential buyer pool for sellers...

Further, NAR has agreed to enact a new rule that would require MLS participants working with buyers to enter into written agreements with their buyers. NAR continues, as it has done for years, to encourage its members to use buyer brokerage agreements that help consumers understand exactly what services and value will be provided, and for how much. These changes will go into effect in mid-July 2024.

"Nationally, lower commission rates were associated with fewer page views, more days on market and lower odds of a sale." The odds of sale were less than half as likely for buyer agent commissions offered under 2%.

Per a Housing Wire publication with data from a first of its kind study "Et Tu Agent" by Jordan Barry, Will Fried, & John Hatfield, note the quote in the title of this section, with the following graphs to show a quantitative approach on that data as well as their hypothesis:

"If buyer agents truly steer their clients, the researchers theorized, then Redfin listings with lower-than-market-rate buyer agent commissions should get fewer page views than those with market-rate commissions. That would likely indicate agents aren’t sending their clients links to those properties, the hypothesis goes."

Images courtesy Housing Wire

Many Agents Tend to Direct Buyers' Attention Away from Low Commission Properties, Even Though They Aren't Supposed to Without Buyer Authorization

Per a Housing Wire publication:

"The researchers scraped this data from Redfin’s website over several months and amassed what they believe to be “the first systematic, nationwide evidence that buyer agents do in fact steer clients away from properties that offer low buyer commissions.”"

One of the top ways that buyers' agents do this steering is by "concierge mode" where they manually weed out properties before sending it to buyers when it meets the buyer's search criteria. In some cases, a buyer will tell them to if properties don't meet the minimum commission the agent requires. In some cases, a buyer will have a certain cap that they can afford out of the commission that they establish. In other cases, the agent will take the liberty without a discussion, even though they shouldn't.

By the way, that's not the only reason to avoid "concierge mode". I don't recommend concierge mode due to the inherent delay. With the recent settlement, the commissions are supposed to no longer be visible in MLS, though that hasn't happened yet in many markets.

Per the HousingWire article:

"The study’s authors addressed this concern by conducting a survey. Of the 184 respondents who purchased a home within the last five years:

92% said their agent e-mailed or texted them properties of interest

of that group, 90% reported viewing them on public portals such as Zillow, Trulia, Realtor.com and Redfin

the median buyer viewed 70% of the listings their agents recommended

NAR’s own research reinforces the claim that agents have steering power, the researchers note. NAR’s 2023 Home Buyers and Sellers Generational Trends Report states that 29% of home buyers purchased a home their agent found, and “help find[ing] the right home to purchase” was the top result when buyers were asked what they want most from their agents.

Even when a client finds a property they want to see, opportunities for steering remain, the study notes. In one of REX’s recorded calls with a broker, for example, a broker who was frustrated with REX’s fee process says that they would simply tell their client – who found the REX property on Zillow – that the property had sold."

Beyond concierge mode, the opinion of the agent can matter a lot on the buyer's choice of home purchase. While the buyer's agent is supposed to have a fiduciary duty to do otherwise, a buyer's agent could wrongfully dissuade a buyer from a purchase without ever mentioning the fact that it's offering a low commission, no commission, or not the highest commission among the properties a buyer is seeing.

You'll be Cutting Out Some Buyers from the Buyer Pool Due to Minimum Commissions in Buyer Brokerage Agreements Even if the Agent Does What They are Supposed to Do

Even if buyers see a property available, and even if an agent doesn't direct their attention away from it, sellers still aren't off the hook. The new NAR settlement requires written buyer brokerage agreements. Even before then, some states like VA have required written buyer brokerage agreements for years for a purchaser if that purchaser wants to be represented on their side of a transaction independent of a listing agent. A buyer brokerage agreement typically includes a minimum commission % &/or a $ amount. In SE VA, while I don't have the benefit of the kind of data we saw with the REIN MLS data I pulled nor the data from the Housing Wire article, it's not uncommon to see 2%-3%, but some agents may not even have one and I've seen as high as 4% (no matter the price). Sometimes there's an additional $ figure as well, such as in my own buyer brokerage agreements for any property that is purchased that is <$150k where it's solely based on that $ figure rather than the %. Other times, agents may simply not do low value transactions.

Most agents only do exclusive buyer brokerage agreements, not even mentioning the possibility of non-exclusive agreements. Some brokerages won't even allow non-exclusive buyer brokerage agreements. An exclusive agreement locks a buyer into using that agent for a period of time if they end up purchasing in that agent's coverage area. The buyer is committed. For those using an exclusive buyer brokerage agreement, the buyer's agent may ask the buyer if they want to see properties that don't meet their minimum commission agreement. Some buyers may say that they do, and some buyers may say that they do not. If they say that they do want to see them, it means that if they make an offer, they would likely be coming out of pocket to pay for the difference to the buyer's agent. For those using a non-exclusive buyer brokerage agreement, the buyer may be on their own for a showing if they want to see something that's an amount below the minimum amount in their buyer brokerage agreement.

VA loan buyers are supposed to not be charged anything by the buyer's agent, so in areas like Hampton Roads where there are a number of VA buyers, some agents may simply not show buyers your listing if it is below their minimum commission, even if only by a fraction of a %. While some buyer's agents may make exceptions for VA buyers, others will not.

The Top # of Closings Builder, Who Does the Highest Revenue is Also One of the Most Generous W/ Buyer's Agent Commissions

The same builder has ranked #1 for over a decade in terms of the number of closings. The same builder tends to have the highest revenue of all builders. That builder is D.R. Horton. How do they do it? There are many factors involved, but low commissions isn't one of them.

Instead, they have the opposite approach. Don't just give buyer's agents a 3% commission (which is the median amount in REIN MLS in the data that I pulled in 2021). D.R. Horton often gives buyer's agents a higher than typical commission.

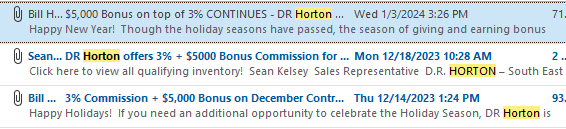

If you take a peek at my email inbox, you see exactly that:

They provide even more on some properties over $500k, i.e. the following:

Image courtesy D R Horton.

Hampton Roads Buyer Agent Commission Data from REIN MLS

REIN MLS (the top MLS of Hampton Roads) knew that some agents would eliminate properties with low commissions (regardless of whether or not their buyers requested that they not see properties where the buyer would need to come up with a portion of the commission to compensate for the buyer's agent's minimum commission policy). In order to make it slightly more difficult, during my career, they removed the ability for agents to see commissions in spreadsheet form.

Before REIN made that change, I pulled the data on commissions in 2021 of under 2% throughout REIN, which is the primary MLS of Hampton Roads.

Who is Listing Under 2% in Hampton Roads (.3% of active listings, excluding Ryan Homes, in a 2021 search)?

Images courtesy Housing Wire

In Hampton Roads, where REIN MLS is the primary MLS used, the majority of commissions under 2% on single family homes were from a single source: Ryan Homes

With new community new construction, many buyers don't use buyer's agents, which is 1 of the reasons why Ryan Homes (a division of NVR) can get away with it. That said, the fact that D.R. Horton tends to go above typical commission in our market while generating the most closings consistently for over a decade nationwide, says a lot. By comparison, D.R. Horton did 3.6x as many closings.

If you exclude Ryan Homes' 82 active listings when I pulled the data in 2021, 10 other properties were under 2% commission. That's out of 3582 properties, so a total of 2.6% of active listings. If the Ryan Homes properties are excluded, that's 10/(3582-82)=.3%

Who is Listing Under 2.5% in Hampton Roads (3.2% under $200k in a 2021 search)

While I didn't know when I was pulling the numbers in 2021 that the option to use this information would be taken away soon after, in 2021, I did check the commissions under 2.5% for properties under $200k.

Out of 789 homes (single-family residential), between 24-25 homes (the commission of 1 was unclear) were under 2.5% commission. That's approximately 3.2% based on 25/789 homes.

If the option was still available to do another search using spreadsheet form to get the #'s including but not limited to under $200k, I absolutely would, but since REIN MLS took that privilege away from all agents, it's no longer nearly as viable to quickly pull the data.

% Commission Varies by Market

Markets vary regarding this subject also. In a market like Greenwich, CT, you might not have the same median commission as you have in Hampton Roads, because the prices there are so much higher than they are here. Even within the same market, lower price points can have higher % commissions while higher price points may have lower % commissions.

What if You Get an Offer with a Lower Commission than What You're Offering?

If it's a reasonable request, and there isn't a better offer, I often recommend that sellers acquiesce to the request. Money up front for buyers often means more than that same amount for sellers due to capital gained via equity for sellers. Many buyers don't have the funds to pay the difference in commission or would incur a financial strain to do so.

Related:

Comments