Guide to HUD Homes

- Adam Garrett

- May 6, 2022

- 6 min read

Updated: Jan 29

1. Owner Occupants, Nonprofits, & Government Agencies Only May Initially Make Offers

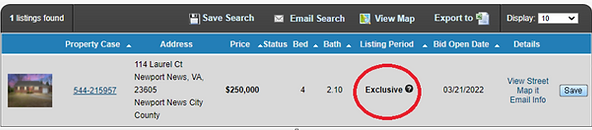

There is typically an “exclusive” period initially where only certain people can bid, narrowing down the competition & eliminating all non-owner occupant for-profit investors:

By hovering over the "?" you can see what exclusive means:

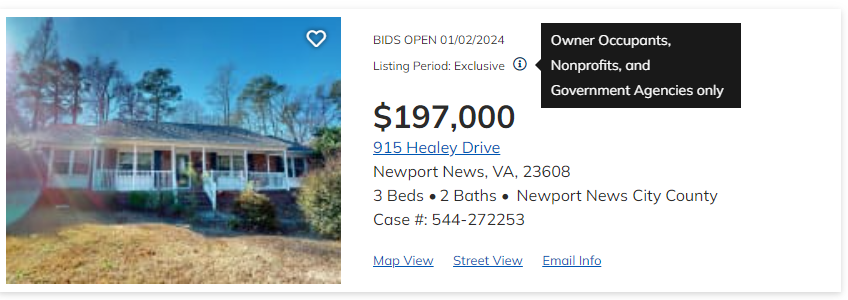

Once you click on the page, you also see what Exclusive means:

If looking to filter by exclusive (or non-exclusive) properties in a search, keep in mind that you can do it, but as of 12/21/23 you can't have more than 1 city or county in a single search unless searching by state.

To do that, click on "More Filters", select your category, then click "done".

2. No Escalation Clauses are possible (biggest negative of HUD homes).

Escalation clauses are a key element of many buyers winning, especially in a hot market. That's even more true in a situation where offers are presented directly to the seller where the listing agent in many cases doesn't even know whether or not an offer is on the table, much less what the offer that has been made is. The unavailability of escalation clauses is a huge disadvantage in a market where median price is very close to asking price, but where prices can be substantially less or more than asking price. With the listing agent not receiving offers, & no escalation clauses possible, you are somewhat shooting in the dark when you make an offer on a HUD home, more so than with many other properties.

See also: How's the Market?

3. Bid Deadlines Mean There's no Reason to Rush to the Home on Day 1

You can be more relaxed than typical about showing if you request one shortly after listing because they list deadlines that they will respond to a bid on the website hudhomestore.com . Below I'm looking at a home listed today.

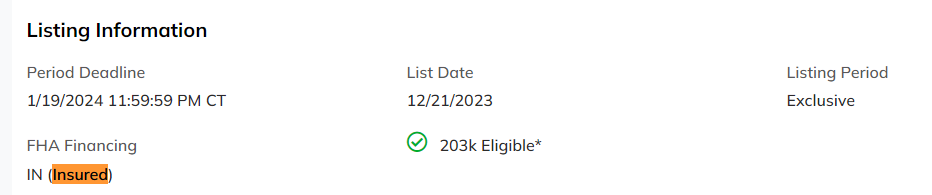

The date of the initial bid deadline and the date of the "period" (the exclusive period, in this case) is different:

4. Price Reductions & Going Below or Above List Price (i.e. 63% went above list in Hampton Roads; average price/list price was 6% above asking price, but up to 50% above)

I got the following numbers in a sample I took out of 139 properties, taken on 12/21/23 in 700 days of history of REIN MLS (the primary MLS of Hampton Roads):

The earliest price reduction I found was 48 days.

That said, there was 1 property that went under contract on day 10, then went back on the market on day 110, then went pending again on day 238 with no price reductions and which sold at list price.

Only 10.1% of properties in that sample went down in list price, and 1 property went up in list price.

20.3% of properties sold below list price (59.5 day median market time; 24 day minimum; 184 day maximum). The greatest % below list price was 20.63%. Median was 6.2%. Minimum was .6%.

15.9% of properties sold at list price (37.5 day median market time; 17 day minimum; 238 day maximum).

63% of properties sold above list price. (25 day median market time; 11 day minimum; 194 day maximum). The highest % above list price was 50%. Median was 7.7%. Average across all (below, at, and above list price) was 6% above.

5. Different Offer Process

The offer process is different than normal with a special offer form etc. Example Online Bid Submission offer form (3.17.22)

6. Utilities Typically Aren't On, & You'll Typically Need to Pay for & Cut Them On Yourself if Looking to do an Inspection

Typically you'll need to turn on utilities yourself if you want a home inspection, which can be a hassle often (i.e. needing to be at the home all morning or all day for a single utility turn on), and is often in just a narrow window of time provided. That adds liability as well in the event that damage occurs to the house based on the utility turn on, i.e. if the pipes freeze and burst in the winter. Some utility companies charge hefty fees to turn the utilities on initially (i.e. $450), which may be refundable or not. Some utility companies will need you to show up in person to the facility, and may only rarely make exceptions if they make any exceptions (i.e. if you're out of state).

Related:

7. Check the “property condition report” on hudhomestore.com

They list a “property condition report” on hudhomestore.com as well. The supposed issues can be wrong in some cases and they can miss problems in other cases. For instance, with my home, HUD said that the plumbing pressure test didn’t pass, but in actuality, a faucet was turned on, messing up the test.

8. Listing Agents Don't Get Offers Directly

The listing agents don’t see the offers, so may or may not know about any offers. In some cases, the buyer’s agent informs them about one, but I don’t recommend that we do overtly.

9. Meaning of "Insured", "Insured w/ Escrow", & "Uninsured"

If it's uninsured, repairs needed to pass an appraisal exceed $5k at least on an FHA loan.

If it’s insured w escrow, you’re usually talking less than $5k in repairs where you have the ability to go w/ an escrow holdback as long as you're either buying in $ or using a lending institution that allows escrow holdbacks.

If it’s insured, you’re talking a loan that can close w an FHA loan with no escrow holdback necessary.

With an escrow holdback, you would be putting the money forth prior to closing (typically repair costs + a % for unforseen costs) and having the work done by a contractor (buyers who are contractors typically need to use someone else) within a short time following closing, i.e. 30 or 60 days.

10. "Home Sold Subject to CFR 206.125"

Sometimes you’ll find something about a home sold subject to CFR 206.125, with detailed guidelines involved for the purchase, i.e. everything under asking price will be countered unless another offer is at or above asking price. If that's the case, be sure to check the link for more details.

11. Buyer Financing Incentives

Sometimes there are incentives for buyers including special financing options, but your lender still needs to be able to do it if you’re using a loan.

These incentive addendums commonly list broker bonuses and buyer incentives on the same form, but you don’t need to do what’s necessary for the agent bonus (i.e. the buyer using an FHA rehab loan) to get the buyer incentive (i.e. a $100 down payment with FHA insured financing).

12. 50% Off Limited Options w/ Full-Time “EMTs, Teachers, Firefighters, & Law Enforcement"

If you are full-time “c" be sure to check out the 50% off options with Good Neighbor Next Door Program.

3% Closing Cost Assistance Available

While it could definitely hurt your chances of winning in a multiple offer scenario, 3% closing cost assistance is often allowed with HUD homes. When I purchasea a HUD home, I received the home for asking price and received 3% closing cost assistance.

When to Buy

Because of the high % of HUD properties going over asking price in the data I collected in Hampton Roads, the inability to include an escalation clause, & market trends where properties in the Hampton Roads market tend to go for less with less competition in the Winter, Winter is the best time to buy them as long as you are in a good position to buy in the Winter. Buying specifically near the beginning of (though day 1 vs day 3 doesn't matter) the exclusive period (see section 1 above) is ideal if you cqualify for it.

Related:

Phantom Property Availability is More Common

Properties that appear to be available but aren't really are more ommon among HUD homes. To check availability, go to Hudhomestore.

16. More from others

Investor’s Guide:

http://investfourmore.com/2013/03/the-investors-guide-to-purchasing-hud-homes/

Owner Occupant’s Guide:

http://investfourmore.com/2013/04/owner-occupants-guide-to-purchasing-hud-homes/

Images courtesy Hudhomestore.com

Related for Buyers:

Comments