Financial (i.e. Tax) Incentives for Investment Property, Businesses, Commercial & Industrial Real Estate in the US & Virginia

- Adam Garrett

- Nov 25, 2023

- 20 min read

Updated: May 19, 2025

Image courtesy City of Hampton

While much is said of various incentives available for owner-occupant home buyers, not nearly as much attention is placed on the businesses, non-profits, & others who are looking to invest in real estate & otherwise nationally, on a state level, nor on a local level. Much of the below is also available at the Virginia Economic Development Partnership Incentives page, & some are available at the Virginia Tax Credits page, & it's best to check those sites in addition to the below list due to items below that are not present there & items on each page that are not present here, as well as the most up to date information on those items that are partly or fully replicated below. A prime example of an item not on either page is the Low Income Tax Credit, which has only been available in VA at the federal level since 2010, when the VA portion of the Low Income Tax Credit was repealed.

Nationally Available Programs in at Least a Portion of Most States Including VA:

Low-Income Housing Tax Credit (LIHTC)

US Low-Income Housing Tax Credit (LIHTC)

"The IRS has a pool of tax credits that it divvies up every year among 58 state and local housing finance agencies, based on population size. Let’s say you’re a developer and you want to build an apartment building with units designated for low-income people. To decrease rents, you’ll need help to offset your costs. That’s where those tax credits come in. First, you go to your housing finance agency to request money to build.

You promise to:

Offer a certain amount of low income units and keep it that way for at least 30 years. Meet the housing agency’s requirements.

For example, you might set aside accessible units for handicap individuals. If your application is approved, the housing agency gives about 70 percent of your allowable cost in tax credits, which your investor can claim for 10 years once the building is completed. But tax credits are dollar for dollar reduction in tax liability for owners (just a promise that you won’t have to pay as much at tax time) and are not very useful for buying concrete or labor."

https://nnrha.net/_docs/Primer%20-Low%20Tax%20Housing%20Credit%20PP.pdf

Here's more information on taking advantage of the federal low-income housing tax credit in Virginia.

Communities of Opportunity Tax Credit (Tax Credits for Section 8 in <10% Poverty Areas)

USA Low-Income Housing Tax Credit (LIHTC)

"It is intended to decentralize poverty by enhancing low-income Virginians’ access to affordable housing units in higher-income areas. To do this, COTCP provides Virginia income tax credits to landlords with property in eligible census tracts throughout Virginia who participate in the Housing Choice Voucher program."

"COTCP is targeted to landlords leasing qualified housing units located in eligible census tracts throughout Virginia with poverty rates of less than 10 percent based on the most recent U.S. Census data. See program guidelines for link to Census website."

"COP Tax Credit Benefits

The amount of tax credit is 10% of the annual fair market rent for one or more units rented to a tenant with a housing choice voucher in the same tax year. Any credits not taken in the year allocated may be carried forward for five years as funds are available."

Historic Rehabilitation Tax Credits (20+%)

Per National Park Service on the Incentives Available w/ the Historic Preservation Tax Credit, it's a 20% tax credit available for eligible rehabilitation expenses nationally from the federal level, with additional state credits, i.e. an additional 5% for the historic tax credit in Virginia.

"A 20% income tax credit is available for the rehabilitation of historic buildings that are determined by the Secretary of the Interior, through the National Park Service, to be “certified historic structures.” The buildings must be considered depreciable under the Internal Revenue Code, such as in a business, commercial, or other income-producing use. The State Historic Preservation Offices and the National Park Service review the rehabilitation work to ensure that it complies with the Secretary’s Standards for Rehabilitation. The Internal Revenue Service defines qualified rehabilitation expenses on which the credit may be taken. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit. Learn more about this credit before you apply."

See more about the Historic Preservation Tax Incentives from the federal level.

The IRS has a solid page on the subject of historic rehabilitation tax credits at a federal level.

Qualification standards can vary from federal to state level.

Per DHR on the historic credit in Virginia:

"Under the Federal Program, a certified historic structure is one that is either:

Individually listed on the National Register of Historic Places, or

Certified as Contributing to a Historic District that is so listed.

Under the State Program, a certified historic structure is one that is:

Individually listed on the Virginia Landmarks Register or National Register, or

Certified as a contributing structure in a Historic District that is so listed, or

Certified as eligible for listing.

Please note that for the State Program, a final listing on the State or National Registers is not required. A formal finding of eligibility for listing will enable a structure to participate in the Virginia Historic Rehabilitation Tax Credit Program. See the “Preliminary Information Form” document for more information on requesting a formal finding of eligibility for a structure that is not currently listed.

With a few exceptions, most Virginia properties that are listed on one of these registers are listed on both. Note, however, that National and Virginia Register historic districts may differ from locally designated historic districts. Certification that a building contributes to a listed district, or, for purposes of the State credit, is eligible for individual listing, is obtained only by submitting the Part 1 application for review.

The proposed use of a building also has an impact on potential eligibility for the State and Federal Programs:

For the Federal Program, only income-producing properties are eligible for HRTCs.

For the State Program, both income-producing properties and owner-occupied homes are eligible for HRTCs."

"IRS Section 1202 - Capital Gains Tax Exclusion provides a 100% federal capital gains tax exclusion in some small business investing"

26 U.S. Code § 1202 - Partial exclusion for gain from certain small business stock

The amount is 50%-100% of the capital gain, with 100% applying for certain small business stock purchases during part of & following 2010.

Per that code:

"(c)Qualified small business stockFor purposes of this section—

(1)In generalExcept as otherwise provided in this section, the term “qualified small business stock” means any stock in a C corporation which is originally issued after the date of the enactment of the Revenue Reconciliation Act of 1993, if—

(A)

as of the date of issuance, such corporation is a qualified small business, and

(B)except as provided in subsections (f) and (h), such stock is acquired by the taxpayer at its original issue (directly or through an underwriter)—

(i)

in exchange for money or other property (not including stock), or

(ii)

as compensation for services provided to such corporation (other than services performed as an underwriter of such stock).

(2)Active business requirement; etc.

(A)In general

Stock in a corporation shall not be treated as qualified small business stock unless, during substantially all of the taxpayer’s holding period for such stock, such corporation meets the active business requirements of subsection (e) and such corporation is a C corporation.

(B)Special rule for certain small business investment companies

(i)Waiver of active business requirement

Notwithstanding any provision of subsection (e), a corporation shall be treated as meeting the active business requirements of such subsection for any period during which such corporation qualifies as a specialized small business investment company.

(ii)Specialized small business investment company

For purposes of clause (i), the term “specialized small business investment company” means any eligible corporation (as defined in subsection (e)(4)) which is licensed to operate under section 301(d) of the Small Business Investment Act of 1958 (as in effect on May 13, 1993)."

Hub Zones (for Small Businesses Seeking Government Contracts)

While typically landlords for residential property don't benefit much directly from being within a hub zone, there are some benefits available for businesses that are located within Hub zones that meet certain criteria.

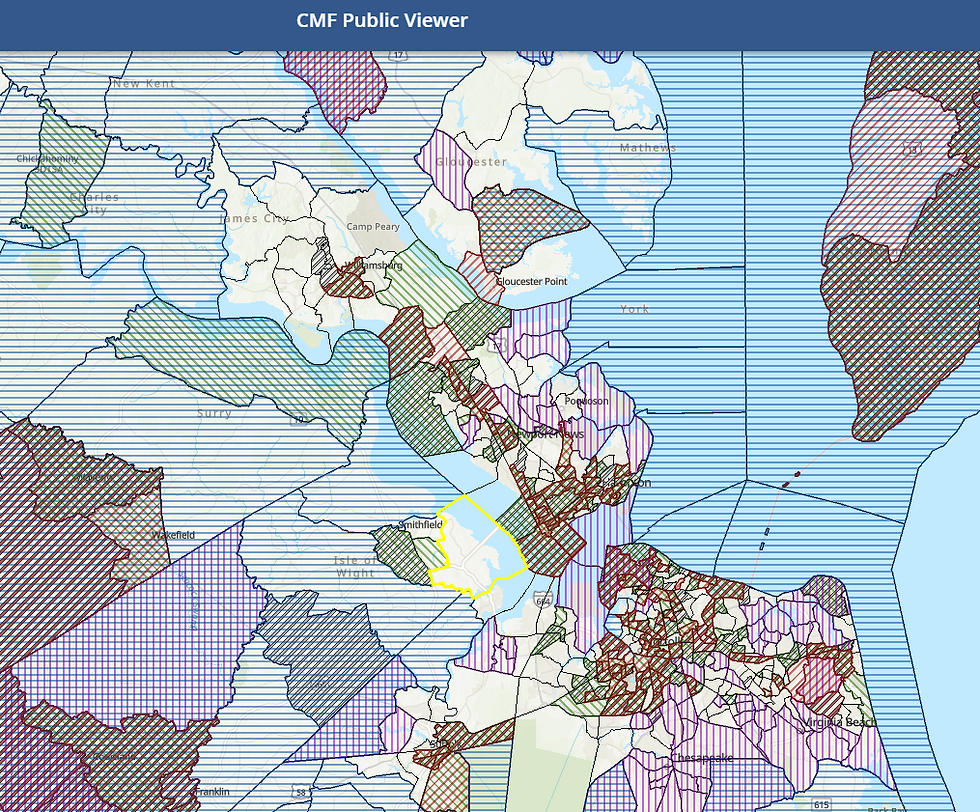

Image courtesy maps.certify.sba.gov/

Per SBA.gov, as of 11/25/23

"Program benefits

1. The government limits competition for certain contracts to businesses in historically underutilized business zones. It also gives preferential consideration to those businesses in full and open competition. 2. Joining the HUBZone program makes your business eligible to compete for the program’s set-aside contracts. HUBZone-certified businesses also get a 10% price evaluation preference in full and open contract competitions. 3. HUBZone-certified businesses can still compete for contract awards under other socio-economic programs they qualify for.

HUBZone program qualifications

To qualify for the HUBZone program, your business must:

Be a small business according to SBA size standards

Be at least 51% owned and controlled by U.S. citizens, a Community Development Corporation, an agricultural cooperative, an Alaska Native corporation, a Native Hawaiian organization, or an Indian tribe

Have its principal office located in a HUBZone*

Have at least 35% of its employees living in a HUBZone*

You can find the full qualification criteria in Title 13 Part 126 Subpart B of the Code of Federal Regulations (CFR). "

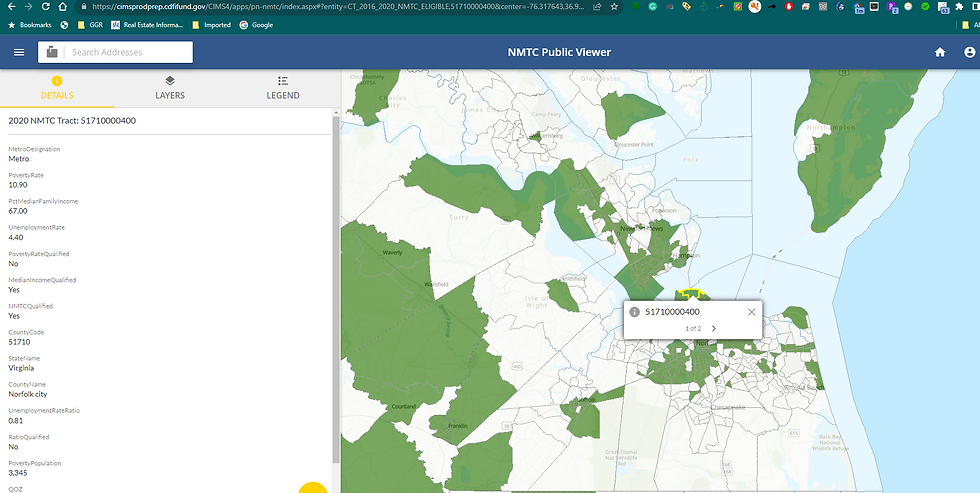

New Markets Tax Credit (Tax Credits for Investment in Community Development Entities)

Per cdfifund.gov,

"A Community Development Entity (CDE) is a domestic corporation or partnership that is an intermediary vehicle for the provision of loans, investments, or financial counseling in low-income communities."

"The NMTC Program attracts private capital into low-income communities by permitting individual and corporate investors to receive a tax credit against their federal income tax in exchange for making equity investments in specialized financial intermediaries called Community Development Entities (CDEs). The credit totals 39% of the original investment amount and is claimed over a period of seven years."

Image courtesy NMTC Public Viewer

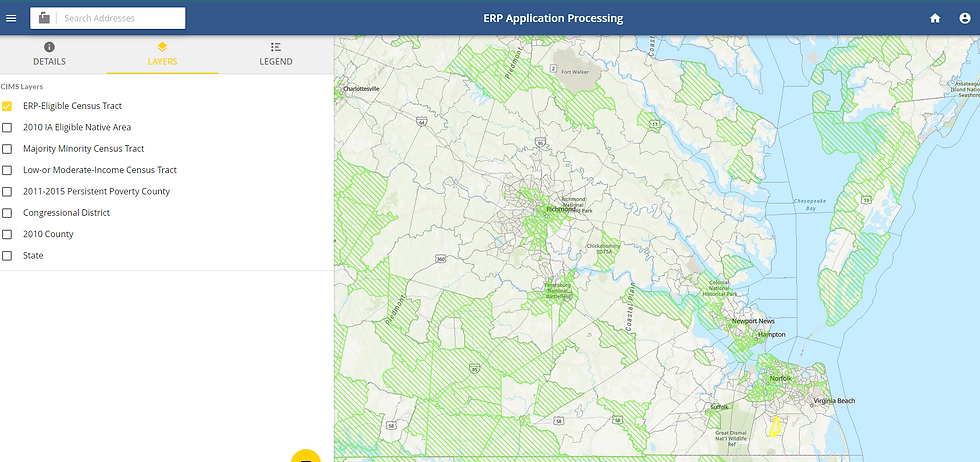

CDFI Equitable Recovery Program (for Community Development Financial Institutions)

Per CDFIFund.gov, "CDFI ERP is designed to: 1) provide funding to CDFIs to expand lending, grant making and investment activities in low- or moderate-income communities and to borrowers that have significant unmet capital and financial services needs and have experienced disproportionate economic impacts from the COVID-19 pandemic, and 2) enable CDFIs to build organizational capacity and acquire technology, staff, and other tools necessary to accomplish the activities under a CDFI ERP Award."

Image courtesy CDFI Fund

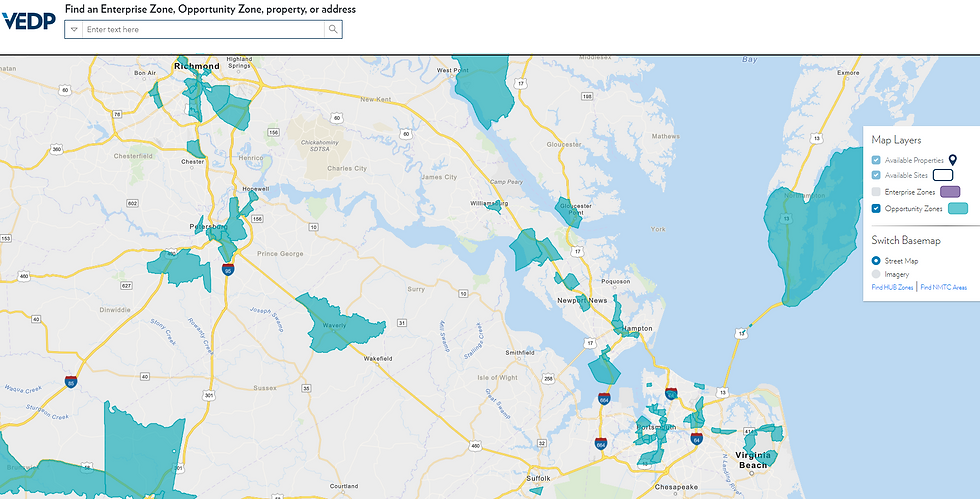

HUD Opportunity Zones (Equipment, Buildings, Property, and Businesses)

Per HUD: for Entrepreneurs, "Investors create Qualified Opportunity Funds (QOF), which have the flexibility to invest in equipment, buildings, property, and businesses."

"Qualified Opportunity Zones were created by the 2017 Tax Cuts and Jobs Act. These zones are designed to spur economic development and job creation in distressed communities throughout all 50 States, the District of Columbia, and the five U.S. territories by providing tax benefits to investors who invest eligible capital into these communities."

"Investors can defer the taxation of certain prior gains invested in a Qualified Opportunity Fund (QOF) until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. Second, if the QOF investment is held for at least 5 years, 10% of the gain that was originally deferred is eliminated completely. If the QOF investment is held for at least 7 years, an additional 5% (15% total) of the original deferred gain is eliminated completely. Third, if the investor holds the QOF investment at least ten years, when the investor sells or exchanges the investment, the investor is eligible to eliminate the gain on the QOF investment from any increase in value of the QOF investment during the investor’s holding period."

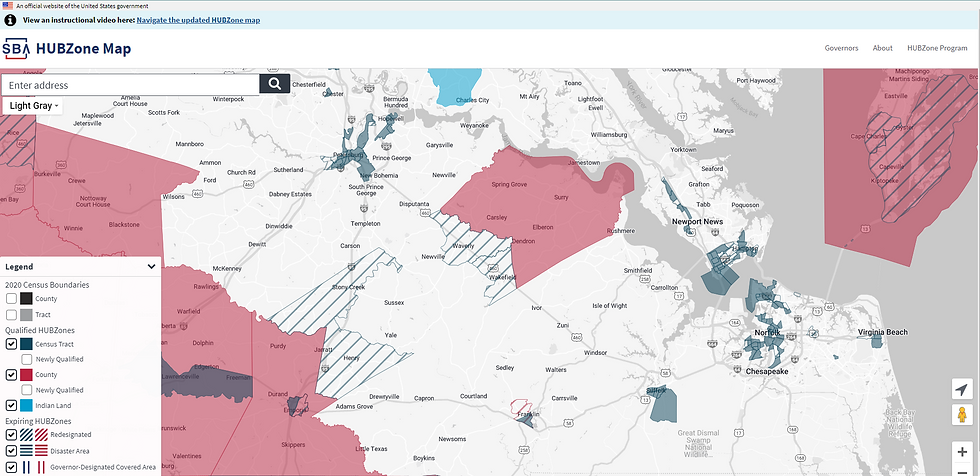

Capital Magnet Fund (for Community Development Financial Institutions & Nonprofit Affordable Housing Organizations to Finance Affordable Housing & Revitalization)

Per CDFIFund,

"The CMF Program offers competitively awarded grants to CDFIs (Community Development Financial Institutions) and nonprofit affordable housing organizations to finance affordable housing solutions and community revitalization efforts that benefit individuals and families with low-incomes and low-income communities nationwide."

Image courtesy CDFI Fund

Bank Enterprise Award (for Depository Banks)

Boating Infrastructure Grant (Marinas/Tie Up Facilities)

Clean Vessel Act (CVA) Grant (Marinas/Tie Up Facilities)

US Clean Vessel Act Grant | U.S. Fish & Wildlife Service

Per Virginia Department of Health on the Clean Vessel Act Grant:

"Congress passed the Clean Vessel Act in 1992 to allow the Secretary of Interior to issue grants to coastal and inland States to fund the construction, renovation, operation, and maintenance of sewage pump-out stations and sanitary waste reception facilities. Prior to 1992, the United States Congress conducted a survey of states and found that there were an inadequate number of pump-out stations for Type III marine sanitation devices. For this reason the survey concluded that recreational vessels may be a substantial contributor to localized degradation of water quality. As a result of the Clean Vessel Act, boaters can expect to see more convenient and reasonably priced pump-out and dump stations, resulting in cleaner waters, creating a better habitat for fish and shellfish populations.

The Clean Vessel Act in Virginia provides financial assistance for the installation of sewage pump-out and sanitary waste dump stations. A portion of the funds are used to educate boaters and marina owners on the serious health and environmental threat posed by the discharge of sewage in the marine environment. Federal funds may constitute 75% of a project with the remaining funds supplied by the recipient of the grant money.

If you would like to apply for a Clean Vessel Act Grant, please consult the links below for information and the application associated with the grant process. For your reference you may access the application instructions below.

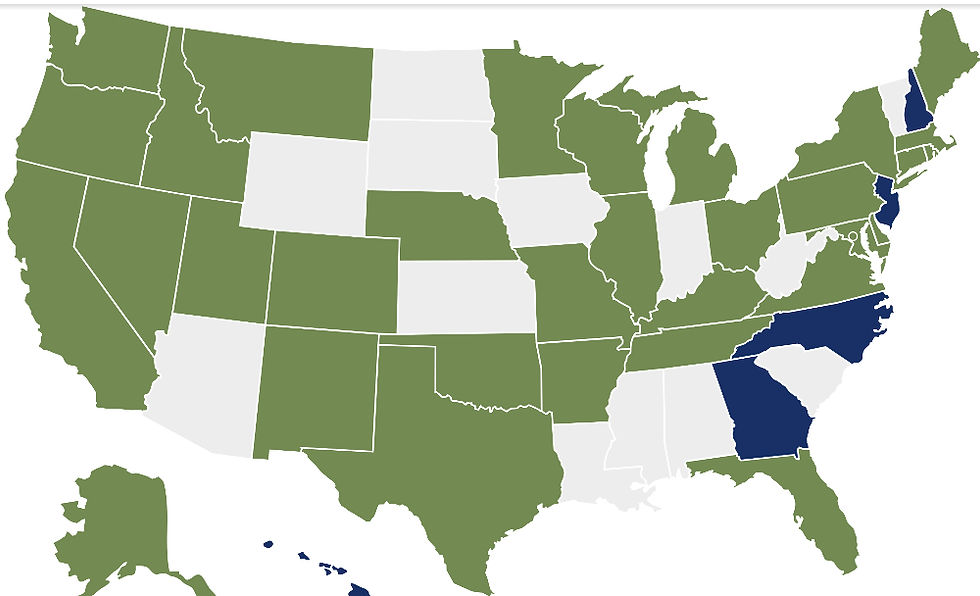

C-PACE - Commercial Property Assessed Clean Energy

Per Energy.gov, "Commercial property-assessed clean energy (CPACE) is a financing structure in which building owners borrow money for energy efficiency, renewable energy, or other projects and make repayments via an assessment on their property tax bill. The financing arrangement then remains with the property even if it is sold, facilitating long-term investments in building performance. CPACE may be funded by private investors or government programs, but it is only available in states with enabling legislation and active programs."

"CPACE may be a good fit if your organization...

Owns or occupies facilities located in jurisdictions with CPACE programs

Wants long-term financing (10+ years) with lower monthly payments

Prefers to do pilot projects at a few locations before implementing more broadly

Does not plan to own or occupy its facilities long-term and wants to transfer financing obligations at the time of sale

Wants to invest in long-term improvements to building resiliency and reliability"

"To be eligible for CPACE financing, a project must be located in a county or municipality that has approved CPACE programs within a state that has passed PACE-enabling legislation. For more details on where CPACE is available, use the tools provided by PACENation. Note that residential PACE (RPACE) is also available in some jurisdictions, but only CPACE is covered in this fact sheet."

Benefits per Virginian Pace Authority:

No money out of pocket: 100 percent financing including hard and soft costs.

Long-term, fixed interest rate financing (up to 35+ years) resulting in lower annual payments.

Typically cash flow positive within the first year.

Property owner may pass through C-PACE Assessment to tenants (if allowed by lease)

Reduces capital expenditure budget – upgrades paid through operating savings.

Eligible measures cover broad capital and facility improvement needs.

Extends building lifespan while improving comfort.

C-PACE assessment transfers upon sale to the next property owner (“runs with the land”).

Programs Available Throughout Many Locations in VA (or all VA):

City/County Based Tax Incentives for Rehabilitation Available in Many VA Localities

"§ 58.1-3220. Partial exemption for certain rehabilitated, renovated or replacement residential structures.

A. The governing body of any county, city or town may, by ordinance, provide for the partial exemption from taxation of real estate on which any structure or other improvement no less than 15 years of age has undergone substantial rehabilitation, renovation or replacement for residential use, subject to such conditions as the ordinance may prescribe. The ordinance may, in addition to any other restrictions hereinafter provided, restrict such exemptions to real property located within described zones or districts whose boundaries shall be determined by the governing body. The governing body of a county, city or town may (i) establish criteria for determining whether real estate qualifies for the partial exemption authorized by this provision, (ii) require such structures to be older than 15 years of age, (iii) establish requirements for the square footage of replacement structures, and (iv) place such other restrictions and conditions on such property as may be prescribed by ordinance. Such ordinance may also provide for the partial exemption from taxation of multifamily residential units that have been substantially rehabilitated by replacement for multifamily use..."

See also:

Article 2.2.

Partial Tax Exemption in Redevelopment or Conservation Areas or Rehabilitation Districts

Partial exemption for structures in redevelopment or conservation areas or rehabilitation districts

"Local real property tax credits on certain rehabilitated, renovated or replacement residential structures"

Partial exemption for certain rehabilitated, renovated or replacement hotel or motel structures

Partial exemption for certain rehabilitated, renovated or replacement commercial or industrial structures"

i.e.

Newport News Residential Rehabilitation Property Tax Abatement

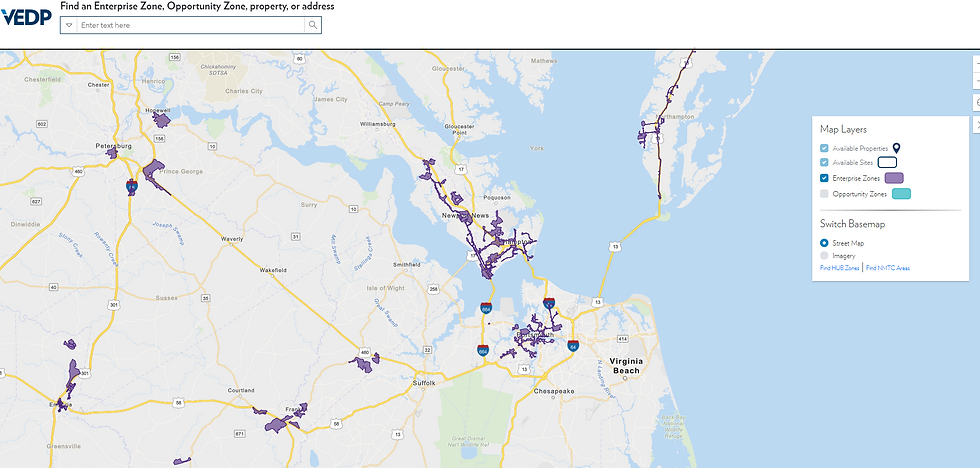

Virginia Enterprise Zones (For Real Property Investment Grant & Job Creation Grant)

Per VEDP regarding the Virginia Real Property Investment Grant, it's for Investors Rehabilitating, Expanding, or Constructing Commercial, Industrial, or Mixed Use w/ At Least 30% of Floor Space Devoted to Commercial, Office, or Industrial Use.

For rehabilitation or expansion of an existing structure, the qualified zone investor must capitalize at least $100,000 in qualified real property investments.

For new construction projects, the qualified zone investor must capitalize at least $500,000 in qualified real property investments.

Investments in machinery and tools and business personal property are not considered real property and should not be included in RPIG calculations.

Per VEDP regarding the Virginia Enterprise Zone – Job Creation Grant:

"Up to $500 annually per grant eligible position filled by an employee earning at least 150% (125% in HUAs and SWAM-certified businesses) of the minimum wage*, who was offered health benefits.

Up to $800 annually per grant eligible position filled by an employee earning 175% of the Virginia minimum wage who was offered health benefits.

For High Unemployment Areas and SWAM-certified Businesses, annual cash grant of $500 per job for jobs paying at least 125% of the minimum wage*; $800 per job for jobs paying 175% of the minimum wage.*

Qualifying companies may claim the grants on up to a maximum of 350 jobs per year.

Requires a four-job threshold to establish a five-year grant period.

Only full-time jobs with health benefits are eligible."

Per VA DHCD, "The Virginia Enterprise Zone (VEZ) program is a partnership between state and local government that encourages job creation and private investment. VEZ accomplishes this by designating Enterprise Zones throughout the state and providing two grant-based incentives, the Job Creation Grant (JCG) and the Real Property Investment Grant (RPIG), to qualified investors and job creators within those zones, while the locality provides local incentives."

Image courtesy VEDP

Be sure to look out for those local incentives that add to what's offered by the state, sometimes not possible throughout all enterprise zones, i.e. those mentioned in the following cities among those & others available in SE VA:

Virginia Opportunity Zones (Equipment, Buildings, Property, and Businesses)

Per DHCD, "Taxpayers can get capital gains tax deferral for making timely equity investments in Opportunity funds that then deploy capital into Opportunity Zone business and real estate ventures. This is an economic and community development tax incentive that provides an avenue for investors to support distressed communities to address areas of the Commonwealth that have experienced uneven economic growth and recovery. The tax incentive offers three benefits; tax deferral, tax reduction through long-term investment, and exclusion of certain capital gains tax."

Image courtesy VEDP

Cities/counties will sometimes have a specific page on the subject, i.e. Virginia Beach.

See also "Virginia Housing Opportunity Credit".

Qualified Equity and Subordinated Debt Investments Credit (Providing Loans to Businesses or Buying Equity from Businesses w/ 50% Income Tax Credit!!!)

Per Virginia Department of Taxation under their Incentives:

"You may qualify for this credit if

You make a qualified investment in a qualified business. The investment should be in the form of:

equity – purchasing the company’s stock or another form of ownership interest; or

subordinated debt – making a certain kind of loan to the business.

We’ll discuss equity and subordinated debt in more detail below.

What is it?

An income tax credit equal to 50% of the qualified investments you made to qualified businesses during the year. You can claim a credit of up to $50,000 on your return, not to exceed your tax liability. Carry forward any unused credits for 15 years.

Claim the credit against the following taxes administered by Virginia Tax:

individual income tax

fiduciary income tax

What is a qualified investment?

A cash investment in a qualified business by buying their stock or other ownership interest, or in the form of subordinated debt.

If you, your family members (spouse, children, grandchildren, parents, spouse’s parents, or grandparents), or an entity that you’re affiliated with received compensation from the business within 1 year of the investment (before or after), your investment isn’t qualified. For the purpose of this credit, we don’t consider reimbursement for reasonable expenses as compensation.

What is a qualified business?

has annual gross revenues of no more than $3 million in its most recent fiscal year

has its principal office or facility in Virginia

is engaged in business primarily in or does substantially all of its production in Virginia

has not obtained during its existence more than $3 million in aggregate gross cash proceeds from the issuance of its equity or debt investments (not including commercial loans from chartered banking or savings and loan institutions)

is primarily engaged in:

advanced computing,

advanced materials,

advanced manufacturing,

agricultural technologies,

biotechnology,

electronic device technology,

energy,

environmental technology,

information technology,

medical device technology,

nanotechnology, or

any similar technology-related field determined by regulation by Virginia Tax to fall under the purview of this section.

Businesses must apply to be qualified annually. To apply, complete Form QBA and send it to us by December 31 of the year that you request qualification.

What is “equity”?

Equity means an ownership interest in the business:

For corporations, it’s their common or preferred stock.

For a limited partnership, it’s a partner interest.

For an LLC, it’s a member interest.

When you make an equity investment, you’re buying 1 of these types of interests.

You must hold your equity investment for at least 3 calendar years after the year you were granted the credit. If the investment requires you to redeem it before 3 years have passed, or if it is subject to an option to redeem it before 3 years, it isn’t eligible for this credit.

What is “subordinated debt”?

A loan to the business that isn’t secured by any of the business’ assets, or guaranteed by anyone. This type of loan is repaid after the business’ other debts are satisfied.

For the purpose of this credit, the terms of the loan can’t require repayment of the principal for 3 years after the loan is issued.

Is there a cap?

Yes. We can issue no more than $5 million in qualified equity and subordinated debt credits per year. 50% of this cap is set aside for “commercialization investments” (investments in qualified businesses who take research developed at or with an institution of higher education and bring it to market). If the total “commercialized” credit requests are less than $2.5 million, the unused portion of the cap will be allocated to the “uncommercialized” credit requests.

If the amount of applications exceeds $5 million, we’ll prorate the credit.

To apply for the credit:

Investors should complete Form EDC and send it to us. From EDC is due by April 1 of the year following the year of the investment. Late applications are not eligible for the credit. We will notify you of the amount of your authorized credit by June 30.

Businesses who wish to become qualified businesses should complete Form QBA by December 31 of the year that you request qualification.

Using the credit

Complete Schedule CR and attach it to your individual or fiduciary income tax return.

We don’t finish authorization of these credits until June 30, after the usual income tax filing deadline. Most taxpayers will need to file during the extension period (see our When to File page for information about Virginia’s automatic filing extension). Or, you can file an amended return to claim the credit.

For more information, see Va. Code § 58.1-339.4."

Commercial and Industrial Sales & Use Tax Exemption (for Equipment Used Directly in Manufacturing and Research and Development Operations)

Per VEDP,

"Virginia offers sales and use tax exemptions for eligible equipment used directly in manufacturing and research and development operations. Prior to exemptions, the Commonwealth’s combined state and local sales and use tax is 5.3% (4.3% state tax and 1.0% local tax).

An additional sales tax is imposed in the Hampton Roads, Northern Virginia, and Richmond regions for a total 6.0% rate, in the City of Danville and counties of Charlotte, Gloucester, Halifax, Henry, Northampton, Patrick and Pittsylvania for a total 6.3% rate...

Manufacturing and research and development operations receive some of the broadest sales and use tax exemptions for purchases used directly in production or R&D offered by any state in the U.S. While many exemptions are possible, some common exemptions include:

Production-related machinery and equipment

Equipment used for production line testing and quality control

Research and development equipment

Utilities used in manufacturing delivered through pipes, lines, or mains

Repair parts"

Commonwealth’s Development Opportunity Fund (COF) (to Secure a Company Location or Expansion in Virginia)

Per VEDP,

"The Commonwealth’s Development Opportunity Fund (COF) is a “deal-closing” fund to be employed at the Governor’s discretion to secure a company location or expansion in Virginia. Administered by the Virginia Economic Development Partnership (VEDP), the COF serves as a final resource for Virginia in the face of serious competition from other states or countries....

The program offers a cash grant to offset/reimburse qualifying project-related costs such as site acquisition and development, transportation access, utility extension or capacity development, construction or build-out of buildings, or training.

A grant is awarded to a local government on behalf of the company. The local government is required to enter into a performance agreement with the company before it may receive the grant award."

Major Business Facility Job Tax Credit (Companies Locating or Expanding in Virginia)

Per VEDP,

"Qualified companies locating or expanding in Virginia are eligible to receive a $1,000 income tax credit for each new full-time job created over a threshold number of jobs beginning in the first taxable year following the taxable year in which the major business facility commenced or expanded its operations...

Components of the Job Tax Credit include:

Thresholds vary by locality

50-job threshold for non-distressed localities

25-job threshold for distressed localities

Threshold number of jobs must be created within a 12-month period

Credit windows range from 24-36 months depending on a number of factors

Virginia Jobs Investment Program (VJIP) (Creating New Jobs or Experiencing Technological Change)

Per VEDP,

"The Virginia Jobs Investment Program (VJIP) is a discretionary program that provides funding to companies creating new jobs or experiencing technological change to reduce the human resource development costs for new companies, expanding companies, and companies retraining their employees.

Funding for each net new full-time job created or full-time employee retrained is based on a customized budget determined by an assessment of the company’s recruiting and training activities, as well as the project’s expected benefit to the Commonwealth, and is subject to approval by the Secretary of Commerce and Trade.

Funding is reimbursable 90 days after the trainee is hired (for new jobs programs) or after the retraining activity has occurred (for retraining programs).

In addition to direct funding to offset a company’s recruitment and training costs, Business Managers offer human resource consultative support at no charge...

Recruitment assistance:

Provide guidance on the recruitment process, timeline, and available assistance from partners.

Assist with the creation of job descriptions and postings or review of descriptions for opportunities for improvement.

Coordinate and promote hiring events.

Connect with state, regional, and local partners’ programs and services.

Raise awareness of company’s ramp up or expansion through partners’ social media channels.

Training assistance:

Evaluate training needs and timeline.

Connect with local education and training providers for technical and soft skills training as well as talent development."

Virginia Talent Accelerator Program (Help w/ Recruitment & Training Solutions)

Per VEDP,

"Virginia understands that attracting and training the right talent is vital to the success of any new operation. The Virginia Talent Accelerator Program’s team of experts develops innovative recruitment and training solutions that accelerate a new operation's start-up. Every solution is fully customized to each client's unique talent needs, processes, and culture."

"Offered at no cost to eligible new & expanding companies considering multiple states for projects that will generate new jobs and capital investment. Eligible projects include manufacturing and a range of business service operations including technology development centers and corporate headquarters."

Specific City/County Programs in SE VA:

Hampton Rock the Block

"In partnership with the Hampton Redevelopment & Housing Authority, Habitat’s home improvement matching grant program can provide as much as $20,000 per house for exterior, curb appeal enhancements in designated neighborhoods. Applicants who are approved through the grant program pay a small portion toward the work is no more than $2,000. Investors and renters pay no more than $10,000 total. Funds are available to all single-family and duplex residential property owners and renters in the designated neighborhood, regardless of income. Renters must have written permission from their landlord submitted with the application. Residents who live in qualifying Hampton communities each cycle can apply for the program by calling 311 to request an application or filling out an application package that is available at the Hampton Redevelopment and Housing Authority, Habitat for Humanity Peninsula and Greater Williamsburg and online at HabitatPGW.org/RockTheBlock ."

"For additional questions about any of the repair programs offered by Habitat for Humanity Peninsula and Greater Williamsburg, email abwk@habitatpgw.org or call the Repair Line at 757-427-8415."

Related:

Overarching Related:

Comments